- The Rise of Digital Wallets 📈

- Streamlining Your Spending with Passbook Apps 💳

- Comparing Top Passbook Apps Features 🤳

- Security Measures to Keep Your Money Safe 🔒

- The Convenience of Sync: Cross-device Use 🔄

- Real User Reviews: What the Public Thinks 🗣️

Table of Contents

ToggleThe Rise of Digital Wallets 📈

Imagine a time when your wallet was a bulky, tangible thing, stuffed with cards and cash that seemed to weigh you down. Those days are rapidly becoming a memory, as digital wallets are swiftly changing how we manage our money 💼➡️📲. It’s like a financial revolution in your pocket. People are turning to their smartphones to do everything that once required digging through a bag for a wallet. This isn’t just a trendy move; it’s about convenience and efficiency. A quick tap here, a quick scan there, and presto—transactions are completed in a flash. It’s clear that we’ve stepped into an era where carrying physical cash is no longer neccessary, and with each passing day, more folks are jumping on the digital wallet bandwagon.

| Benefit | Reason for Rise |

|---|---|

| Easy Access | Your entire spending arsenal is available at a tap, making payments seamless. |

| Innovative Features | Added functionalities like rewards tracking and automatic categorization up the utility. |

| Security | Advanced protections keep your digital money safer than physical equivalents. |

| Global Reach | Send and receive funds worldwide with just an internet connection. |

Yet, with the ascent of these passbook apps, some remain cautious. FUD can creep in, especially when it’s time to trust tech with your hard-earned cash. However, the promises of blockchain and encryptions are strong defenses against modern money woes. And for those who miss out because of doubts? They’re the modern day equivalent of a ‘no-coiner’, missing out on the ease and security of digital spending. Whether it’s FOMO or simple recognition of the convenience offered, people are embracing these apps as the ‘normie’ starts understanding the new money language of our times. It’s possible that soon, questioning the rise of digital wallets will be as outdated as asking “When Lambo?” when talking about getting rich quick.

Streamlining Your Spending with Passbook Apps 💳

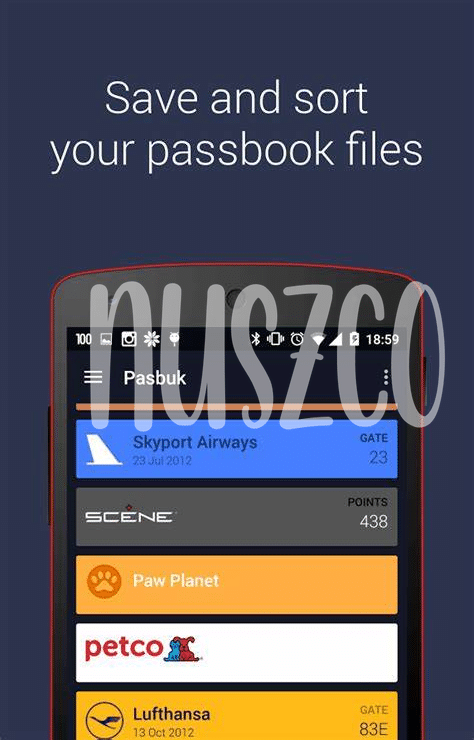

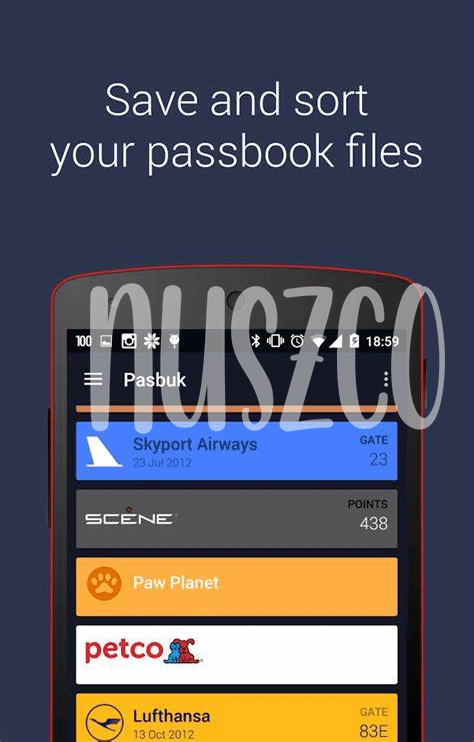

Imagine holding the power to manage your money right at your fingertips — it’s like having a financial wizard in your pocket! Passbook apps have transformed the way we interact with our wallets, making it simpler than ever to track expenses, receive alerts, and stay on top of our budgets wherever we roam. With just a few taps, users can oversee their spending trends without drowning in piles of receipts or manually logging each purchase. It’s the financial ‘ape’ of today, smartly jumping on the best tools to navigate the jungle of personal finance without needing to ‘DYOR’ on every single expenditure.

Integration with stores means offers and loyalty points accumulate autimatically, freeing you from carrying a stack of cards. These apps shield you, so you’re not just another ‘bagholder’ of digital clutter. Plus, their sleek interfaces are designed to make navigation a snap for even the most ‘normie’ users. Whether you’re among the ‘diamond hands,’ riding through the market’s ebbs and flows, or someone who appreciates the peace that comes with streamlined finances, passbook apps redefine the ease of money management. And when it’s time for FUNdamentals, these apps offer insights that echo the wise old adage: it’s not about how much you make, but how much you keep and grow. 💼🌱💡

Comparing Top Passbook Apps Features 🤳

In the bustling realm of digital finance, choosing the right passbook app can be likened to selecting the perfect wallet for your back pocket – it must be functional, user-friendly, and above all else, trustworthy. 🤳 As we peek into some of the most popular passbook apps, it’s apparent that not all are created equal. Some promise lower fees or instant transfers, bringing a twinkle to the eye of anyone looking to ape into the latest digital trend. Others cater to the Bitcoin Maximalist, providing seamless integration for those faithful to the cryptocurrency kingpin.

Each app has its own set of bells and whistles; take, for example, app A, which lights up the scene with its customizable widgets and immersive graphics – a true visual feast! Then there’s app B’s unshakeable focus on security, potentially saving you from the cold sweat of a pump and dump aftermath. Yet, for those with HODL mentality, app C ensures that your digital coins remain untouched, regardless of FOMO inducing news. Comparative analysis reveals that certain apps provide more bang for your buck, letting you track every sat with meticulous precision, while others might make you feel like a bagholder with limited functionalities.

Crucial too are the hidden gems that champion convenience, such as the cross-platform synchronization, which means your money follows you as effortlessly as your shadow, from smartphone to tablet, without missing a beat. 🔄 However, it’s not all about shiny features; the subtleties like customer service responsiveness and the ease of navigation can distinguish a good app from a great one. Sifting through real-world feedback helps shed light on all this, confirming whether those diamond hands are holding onto a trove of utility or, perhaps, a mirage of features gone by. But remember, amidst all the dazzle, it’s wise to DYOR to avoid being swept up by the flashy offering that turns out to be vaporware.

So, as you holster your digital assets in one of these intuitive passbook apps, be comforted in the knowledge that somewhere in the convergence of innovation, security, and user satisfaction, lies the perfect match for your e-wallet needs – a beacon of hope for the savvy spender in this vast ocean of digital possibilities. 🗣️ Just be watchful for those typo gremlins like ‘recieve’ and ‘seperate’, tiny errors wich, oddly enough, can tell you quite a bit about the attention to detail a passbook app may (or may not) uphold.

Security Measures to Keep Your Money Safe 🔒

In our connected world, the feeling of your hard-earned money being just a tap away can send shivers down your spine, but fear not! Imagine a digital fortress where you’re the king, and your wealth is safeguarded by the latest tech knights. Well, that’s what today’s digital wallet apps offer – a kingdom of safety for your transactions. They come armored with iron-clad features like encryption, which scrambles your data into a secret code as it travels. This means even if someone intercepts it, they can’t make head nor tail of it. It’s like speaking in riddles only you have the answer to! Then, there’s two-factor authentication, or as the cool kids call it, 2FA. This is like having a hidden moat around your castle – even if someone guesses your password, they won’t be able to cross without the additional key, often sent to your phone or email. 💬

Now, remember when Mom said not to put all your eggs in one basket? Apply that to digital wallets too. They ensure your eggs – or rather your funds – are spread out in different pots, like various accounts or cards, so even if one pot falls, you won’t be left with egg on your face. But the cherry on top? Some apps offer you a look into the deep waters of the crypto ocean with in-built trackers for Bitcoin and altcoins, allowing you to monitor your investments without getting your feet wet. HODLers and normies alike can navigate these waters with greater peace of mind.

Still, remember, with great power comes great responsibility. Always keep your app updated to ensure the latest defences are in place, and like the old adage goes, don’t put all your trust in one marvel. Sometimes, despite all these measures, a clever cryptojacker slips through, lurking in the shadows, ready to pounce on unpatched vulnerabilities or weak hands. But if you stay alert and informed, you’ll be the hero of your own financial saga, unsullied by the chaos of the markets.

For those looking to explore the extent of what apps can do, what is the best cloud gaming app for android 2024 top 5 apps updated can give you a taste of just how versatile your mobile device can be, expanding horizons beyond mere financial management. Keep these pointers in mind, and recieve the baton with confidence, as you race towards a future where your wealth isn’t just safe—it’s thriving! 🛡️📲

The Convenience of Sync: Cross-device Use 🔄

Picture this: You’ve just wrapped up lunch and your tummy is full. Now, it’s time to sort out the bill. Instead of sifting through a pile of old receipts in your wallet, you pull out your smartphone, where your passbook app holds all your vouchers, coupons, and loyalty cards in one shiny, digital space. 📱✨ But here’s the real kicker – that same passbook app is also on your tablet and laptop. With a few taps, you can check your balances and see where you saved a couple of bucks by choosing the combo meal.

But why is this so handy? Imagine you’re late for a meeting and forget your phone at home. No sweat! Just hop onto your computer at work, and there it is, all your information, safe and ready like a trusty sidekick. Or maybe you’re on holiday, snapping pics with your tablet. 🏖️ A single notification reminds you that there’s a deal on your favorite smoothie just two blocks away. Score!

It’s all about staying connected and not missing out – without the FOMO. Bags of convenience yoked with a sense of security that’s just like having diamond hands, except it’s your finances we’re keeping solid. Whether it’s avoiding the shuffle between devices or simply ensuring you’ve got control no matter where you are, cross-device syncing in passbook apps isn’t just smart; it’s akin to giving your money a superpower.

What’s more, real users are chiming in, sharing stories of how they’ve nailed that last-minute deal or caught a hidden charge just because they had access across all their gadgets. It’s all smooth sailing (or spending!) from here. While some may worry about the techie side of things, it’s the managment of your spending that gets streamlined, so you’re always sailing ahead, not trying to catch up. 🚀

Despite the occasional hiccup, like a typo in your password leading to a momentary panic – we’re looking at you “definately” instead of “definitely” – the verdict is in. Syncing up is not just convenient, it’s a game-changer for savvy spenders on the go.

Here’s a simple table to help you compare the sync features of popular passbook apps:

| App Name | Devices Supported | Sync Quality | User Ratings |

|---|---|---|---|

| Wallet Whizz | Phone, Tablet, Laptop | Seamless | 4.5/5 |

| PayPocket Pro | Phone, Smartwatch | Instant | 4.7/5 |

| Voucher Vault | Phone, Tablet | Highly Responsive | 4.2/5 |

Just remember, in the world of spending smart, staying synced isn’t just a feature, it’s your financial wingman – keeping you ready, no matter where life takes you.

Real User Reviews: What the Public Thinks 🗣️

When you’re deciding whether to trust your hard-earned cash with a new passbook app, there’s nothing quite as reassuring as hearing from those who’ve already taken the plunge. It’s the digital version of peeking over your neighbor’s fence to see if their grass really is greener. Scrolling through page after page of comments and star ratings, you get the honest scoop. Glowing praises might shine a spotlight on the slick interface and hiccup-free usage, and you can’t help but wonder if the reviewers have diamond hands, staying steadfast through the ups and downs of app updates and overhauls. On the flip side, some users might share sob stories of FOMO gone wrong, where promises of mooning efficiency turned into a jarring crash back to Earth. But whether they’re shouting from the rooftops or typing through groans of “been there, done that,” these reviews are like street signs guiding potential users – will you join the ranks of satisfied customers, or wind up facepalming at an “I told you so” moment?

Despite the mixed bag of feedback, it’s clear that real-world experiences are gold dust for developers and customers alike. They help the former tweak and tune, and offer the latter peace of mind – or a timely warning. Just remember, amidst the chorus of opinions, to DYOR – because what works like a charm for Jane might not be Jim’s cup of tea. And yes, amidst this treasure trove of insights, there’s the odd typo – ‘seperate’ accounts for savings and spending, for instance – but the message shines through: the wisdom of the crowd is indispensable as you navigate the landscape of passbook apps, searching for that key to unlock your financial efficacy. 🌟💬🔍