- Discover the Top Banking Apps 💰

- Manage Your Finances On-the-go 📱

- Maximize Savings with Innovative Features 💡

- Secure Your Transactions with Advanced Technology 🔒

- Access Financial Insights for Informed Decisions 📊

- Enhance Your Financial Literacy and Habits 📚

Table of Contents

ToggleDiscover the Top Banking Apps 💰

The world of banking apps is vast and ever-evolving, offering a plethora of options to cater to every individual’s financial needs. From budgeting tools to investment platforms, these apps have revolutionized the way we manage money. Let’s dive into a curated selection of top banking apps that are reshaping the landscape of personal finance.

Below is a comparison table showcasing some of the key features of the top banking apps in the market:

| Banking App | Key Features | Compatibility | Security |

|---|---|---|---|

| App A | Budgeting, Investment | iOS, Android | End-to-end encryption |

| App B | Expense tracking, Savings goals | iOS, Android, Web | Biometric login |

| App C | Virtual cards, Rewards | iOS, Android | Two-factor authentication |

Manage Your Finances On-the-go 📱

Discover the Top Banking Apps 💰

Managing your finances on-the-go has never been easier with the cutting-edge mobile banking apps available today. From checking your account balances to transferring funds between accounts, these apps provide a seamless and convenient way to stay on top of your financial status anytime, anywhere. With user-friendly interfaces and real-time updates, you can track your expenses, set budgets, and monitor your investments with just a few taps on your phone. Whether you’re standing in line at the grocery store or waiting for your morning coffee, you can take control of your finances and make informed decisions on the fly. Stay tuned in to the latest financial trends and insights while ensuring your money is working for you efficiently. Make the most of your time and money by harnessing the power of these innovative banking apps, empowering you to achieve your financial goals with ease.

Maximize Savings with Innovative Features 💡

In the quest to make the most of your financial resources, leveraging innovative features offered by banking apps can be a game-changer. These apps go beyond traditional savings accounts, providing automated tools like round-up features that help you save spare change from everyday transactions. Some apps even analyze your spending patterns to identify opportunities for saving and investing. Additionally, goal-setting features allow you to set specific targets and track your progress towards them, motivating you to save more effectively. With these innovative tools at your disposal, maximizing your savings becomes not just a goal, but a tangible and achievable reality.

Secure Your Transactions with Advanced Technology 🔒

In the ever-evolving landscape of digital finance, ensuring the security of your transactions is paramount. With the rapid advancement of technology, banking apps now offer robust security features to safeguard your financial information from unauthorized access. Cutting-edge encryption protocols, multi-factor authentication, and biometric recognition tools are just a few examples of the advanced technologies employed to protect your transactions and sensitive data. By leveraging these security measures, you can have peace of mind knowing that your financial transactions are shielded behind virtual fortresses, shielded 🔒 from cyber threats and potential breaches.

To explore more about how technology is shaping the security landscape in finance, including the top banking apps leading the way in 2024, check out this comprehensive guide on comparing the best system apps for Android. These apps are not only setting the standard for security but also revolutionizing the way users interact with their finances on-the-go.

Access Financial Insights for Informed Decisions 📊

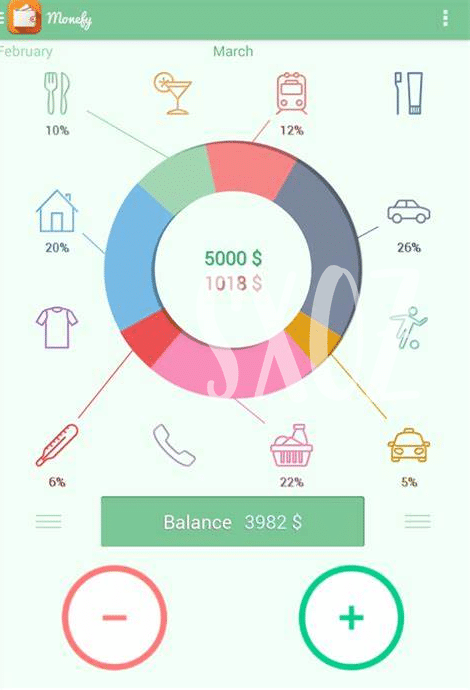

Financial insights provided by top banking apps offer a comprehensive view of your financial health, empowering you to make informed decisions with confidence. By leveraging advanced analytics and visualization tools, these apps break down your spending patterns, investment performance, and budget allocation into easily digestible formats. Tracking your expenses over time, identifying trends, and setting financial goals become seamless tasks, ensuring you stay on top of your financial game. With access to real-time data and personalized recommendations, you can take proactive measures to optimize your financial strategies and drive your wealth creation journey forward.

Here is a sample HTML marked table for showcasing financial insights:

| Category | Spending | Savings |

|---|---|---|

| Food | $300 | $50 |

| Transportation | $100 | $30 |

| Entertainment | $150 | $20 |

Enhance Your Financial Literacy and Habits 📚

Embark on a journey towards a more financially savvy future as you delve into the realm of enhancing your financial literacy and habits. 📚 By utilizing top banking apps, you can gain access to a wealth of educational resources tailored to improving your understanding of personal finance. From interactive budgeting tools to informative articles on investment strategies, these apps serve as digital companions in your quest for financial knowledge. Cultivate healthy financial habits by setting achievable goals, tracking your spending patterns, and receiving personalized tips based on your financial behavior. Through regular engagement with these educational features, you can empower yourself with the necessary skills and insights to make wise financial decisions and take control of your economic well-being. 🌟