- Evolution of Android Wallet Apps 📱

- Advancements in Security Features 🔒

- Emerging Trends in Contactless Payments 💳

- Top New Features and Functionality 🌟

- User Experience and Interface Enhancements 🎨

- Future Prospects and Impact on Financial Industry 💼

Table of Contents

ToggleEvolution of Android Wallet Apps 📱

The evolution of Android wallet apps has been marked by continuous innovation and adaptation to the changing landscape of digital finance. From the early days of basic transaction capabilities, these applications have evolved to encompass a wide range of financial activities, offering users a comprehensive platform for managing their funds, making payments, and even investing. With the integration of advanced technologies such as biometric authentication, secure encryption, and real-time synchronization, Android wallet apps have become more versatile and secure, catering to the diverse needs of modern consumers. Moreover, the seamless incorporation of contactless payment options and seamless integration with various merchants has further propelled the evolution of these apps, aligning with the growing trend towards convenient and efficient payment methods. As Android wallet apps continue to enhance their features and functionality, they are expected to play a pivotal role in shaping the future of the financial industry, driving a shift towards a more digital and interconnected financial ecosystem.

| Evolution of Android Wallet Apps |

|———————————-|

| – Comprehensive platform for managing funds, making payments, and investing|

| – Integration of advanced technologies for security and authentication |

| – Seamless incorporation of contactless payment options and merchant integration|

| – Impact on shaping the future of the financial industry |

Advancements in Security Features 🔒

From AI models securing transactions to biometric authentication, the advancements in security features for Android wallet apps have been nothing short of remarkable. With the increasing threat of cyber attacks, developers have prioritized implementing robust encryption protocols and multi-factor authentication to safeguard users’ financial data. Moreover, the emergence of advanced machine learning algorithms has enabled real-time fraud detection, providing users with an additional layer of protection against unauthorized transactions. These security measures have instilled a greater sense of confidence in consumers, encouraging widespread adoption of Android wallet apps for various financial transactions.

Additionally, the integration of blockchain technology has played a pivotal role in enhancing the security infrastructure of Android wallet apps. The immutable nature of blockchain not only ensures the integrity of transactions but also minimizes the risks associated with potential data breaches. As a result, users can confidently explore the convenience of contactless payments without compromising on the security of their sensitive information. The continuous evolution of security features within Android wallet apps signifies a promising trajectory towards a safer and more secure digital financial landscape.

Emerging Trends in Contactless Payments 💳

Continuous advancements in technology have shaped the landscape of contactless payments, with an increasing shift towards seamless and secure transactions. The integration of near field communication (NFC) technology has allowed for quick and convenient tap-and-go payments at various retail outlets, public transportation systems, and other points of sale. Moreover, the use of mobile wallet apps has facilitated contactless payments through smartphones, offering users a convenient and secure means of conducting transactions on the go. Furthermore, the rise of biometric authentication methods, such as fingerprint or facial recognition, has bolstered the security of contactless payments, providing users with an added layer of protection against potential fraud or unauthorized use. These emerging trends in contactless payments are reshaping the way consumers interact with financial transactions, paving the way for a more efficient and secure payment ecosystem.

Top New Features and Functionality 🌟

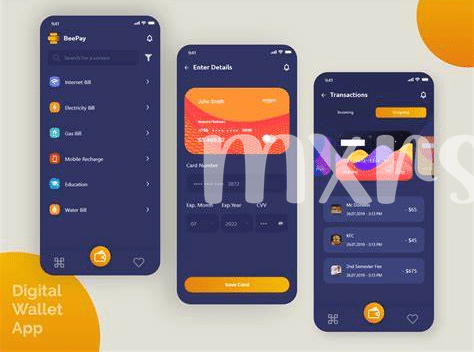

The Android Wallet Apps of 2024 showcase a plethora of new features and functionality, revolutionizing the way users manage their financial transactions. Among the top new features are advanced budgeting tools that provide insightful analysis of spending habits, allowing users to set personalized budget limits. Additionally, the integration of AI technology enables tailored financial recommendations, empowering users to make informed decisions. The introduction of multi-currency support has streamlined global transactions, offering users the convenience of managing multiple currencies within a single app. Moreover, the apps now boast enhanced customization options, allowing users to personalize their interfaces according to their preferences, bringing a delightful and personalized experience to users.

The evolving landscape of Android Wallet Apps has positioned them as indispensable tools, catering to the dynamic needs of users while setting new benchmarks for technological innovation in the financial industry. With these advancements, Android Wallet Apps have redefined convenience, security, and efficiency in managing finances, promising a transformative impact on users’ financial experiences and the industry as a whole. Additionally, these advancements have culminated in an unprecedented level of user satisfaction and engagement, establishing the Android Wallet Apps as integral components of modern financial management.

User Experience and Interface Enhancements 🎨

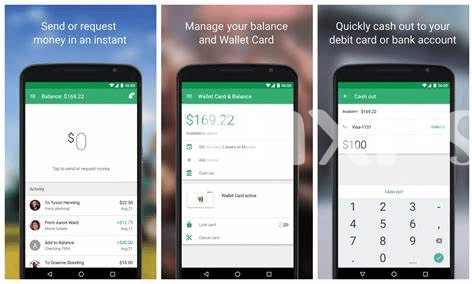

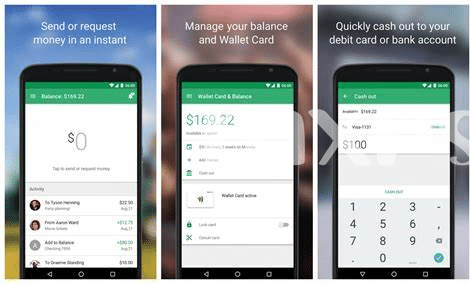

The evolution of Android wallet apps has brought about significant advancements in user experience and interface enhancements. As technology continues to evolve, developers have focused on optimizing the visual appeal and usability of these apps, creating a seamless and intuitive experience for users. The incorporation of vibrant color schemes, interactive animations, and streamlined navigation has transformed the way users interact with their digital wallets. Additionally, personalized customization options have become a prominent feature, allowing users to tailor the interface to their preferences, further enhancing the overall user experience. These advancements not only prioritize functionality but also aim to create a visually engaging and enjoyable experience for users.

In addition, the integration of cutting-edge design elements and intuitive interfaces has played a crucial role in increasing user engagement and satisfaction. Simplified onboarding processes, clear call-to-action buttons, and visually appealing transaction interfaces have contributed to a more user-friendly experience. Furthermore, the seamless integration of biometric authentication and innovative gesture controls has added an extra layer of security without compromising the overall user experience. The future of Android wallet apps undoubtedly revolves around continually improving user interface design and enhancing the overall experience through intuitive and visually captivating elements.

“`html

| User Experience and Interface Enhancements |

|---|

| Evolution of visually engaging interfaces |

| Personalized customization options |

| Intuitive design and user-friendly interfaces |

| Seamless integration of biometric authentication |

“`

Future Prospects and Impact on Financial Industry 💼

The continuous development and integration of Android wallet apps are poised to revolutionize the financial industry, shaping the future of how transactions and financial management are conducted. With the growing adoption of digital payment methods, Android wallet apps are expected to play a pivotal role in driving the shift towards a cashless society and transforming the way consumers interact with their finances. These advancements are not only streamlining the payment process but also paving the way for new business models and opportunities within the financial sector. As Android wallet apps continue to enhance functionalities and security measures, their impact on the financial industry will be substantial, influencing consumer behavior and setting new standards for convenience and security in transactions. Furthermore, the increasing integration of these apps with emerging technologies such as blockchain and AI is likely to introduce further disruptions and innovations, reshaping the financial landscape and driving unprecedented levels of efficiency and accessibility. The symbiotic relationship between Android wallet apps and the financial industry is undoubtedly poised to lead to a more connected, secure, and dynamic ecosystem for digital transactions, offering a glimpse into the future of finance.