- Discover the App That Budgets for You 📊

- Track Every Penny with Clever Expense Organizers 🤑

- Invest Wisely on the Go with Smart Apps 💹

- Say Goodbye to Debt with Nifty Tools 🚫💳

- Secure Your Future with Easy Savings Apps 💰

- Stay Safe: Top Apps for Financial Privacy 🔒

Table of Contents

ToggleDiscover the App That Budgets for You 📊

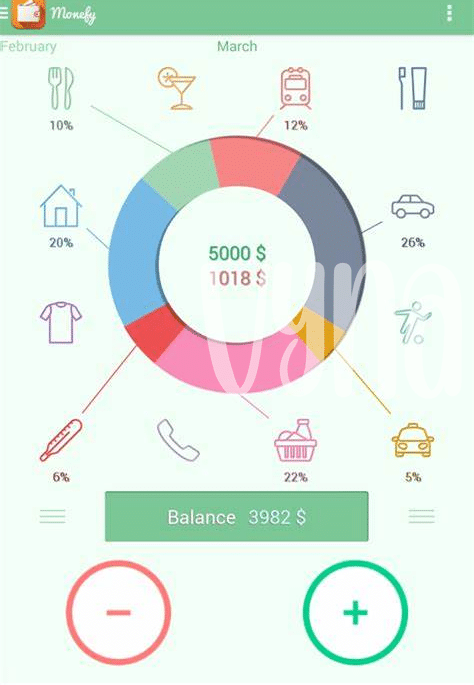

Imagine a little helper right in your pocket, one that keeps track of what you spend without needing much from you. Just feed it some numbers, tell it where your money comes from and where it usually goes, and voilà, you’re all set. This isn’t fantasy; it’s what a budgeting app does for you. These savvy little apps are like having a financial advisor in your phone. They watch your earnings, sort out your spending, and even find patterns you might miss. Take shopping, for example; every time you grab a latte or splurge on a pair of shoes, your app logs it and shows you just how those treats add up over time.

The magic happens when you see everything laid out clear as day. Suddenly, reaching your money goals – whether that’s saving for a big trip, paying off a pesky bill, or simply not running out of cash before payday – feels doable. These apps aren’t just about recording what’s already happened – they help you see into the future, too. Picture this: you’re thinking of grabbing dinner out, but a quick peek at your app shows you’re close to your eating-out limit for the month. Decision made, money saved!

And you know what’s even better? Lots of these apps can give your wallet a break, too, because they’re free or cost very little. Here, check out this handy table of options to get started:

| App Name | Key Feature | Cost |

|---|---|---|

| Money Master | Automatic categorization of expenses | Free |

| Spend Smart | Custom budget goals | Free with in-app purchases |

| Wallet Watch | Bill tracking and reminders | Free with premium version available |

With tools like these, keeping an eye 👀 on your dollars and cents becomes not just manageable, but almost…fun? Yes, we’re going there. It’s like a game, where the prize is your own financial freedom. 🎉

Track Every Penny with Clever Expense Organizers 🤑

Picture this: You’re sipping coffee, flipping through your phone, and there it is—a little digital helper tucked away in your Android, making sure not a single cent slips through unnoticed. These nifty organizers come in all shapes and sizes, promising to take the heavy lifting off your shoulders when it comes to keeping an eye on where your hard-earned money is going. 📱💸 Imagine an app that’s like a detective, always on the case, tracking every coffee date, grocery run, and even those sneaky little online purchases. It’s like having a financial buddy in your pocket, making sure you’re not accidentally spending a little too much on treats for your pet or those super comfy yoga pants.

With graphs, charts, and lists, these apps paint a clear picture of your spending habits, showing you where you can cut back and where you’re just right. And hey, while you’re getting your finances in order, why not also make sure your personal info stays personal? You wouldn’t want anyone peeking at your money matters. For peace of mind while using these apps, consider strapping on an extra layer of security with a virtual private network. Check out “which free VPN app is best for Android 2024 top 5 apps updated?” – because, let’s face it, staying on top of your money also means staying safe online. 🔐💪

With the right app, every penny you spend is a step toward understanding your financial flow better—and that’s the first step to making your money work for you. Now that’s smart spending at its best!

Invest Wisely on the Go with Smart Apps 💹

Imagine being able to grow your money while you’re riding the bus to work or waiting in line for your morning coffee. That’s the magic of having a finance app right on your Android phone. With quick taps and swipes, you can start putting your spare change into investments that can pay off big time down the road. 📈🚀 These smart apps can teach you a thing or two about the stock market, help you dive into the world of cryptocurrency, or just pick the right investment strategy that matches your goals and risk tolerance. It all happens in a simple, user-friendly environment, so even if you’re new to investing, you won’t feel lost.

But let’s take the mystery out of investing even further. The real beauty lies in the personalized recommendations that these apps can give you. 💎📲 They analyze your spending habits, earning patterns, and financial goals to suggest the best investment paths for you. And you don’t need to have a fat wallet to begin; many apps let you start small, learn gradually, and grow your investments over time. Plus, you’ll always be in control. Whether you’re a cautious saver or an adventurous trader, these apps strive to make sure your hard-earned cash is working just as hard as you do to secure a brighter, financially sound future.

Say Goodbye to Debt with Nifty Tools 🚫💳

Tackling debt can often feel like an uphill battle, but with the right tools at your fingertips, it can become a journey of empowerment and success. Imagine an app that’s like a personal financial coach, poking you gently to reconsider that splurge or reminding you of your long-term aims, all with a tap on your bright screen. 🚫💲 In the digital era, such marvels exist; they wrap complex algorithms in user-friendly interfaces, making it less of a chore to chip away at that mountainous credit card bill or that student loan ticking up with interest. Whether it’s by helping you to visualize your payoff progress with colorful charts or simply automating your repayment plans to ensure you never miss a due date, these apps can be a real game-changer.

Keeping a vigilant eye on your financial data is also crucial. Just like how you’d protect your money from pickpockets, protecting it from digital threats is equally important. That’s where a solid Virtual Private Network (VPN) comes into play, especially when you’re managing your money via public Wi-Fi. Wondering which free VPN app is best for Android in 2024? Check out the top 5 apps updated to keep your financial transactions secure without sacrificing speed.

As you equip yourself with these nifty apps, remember that each swipe and tap brings you closer to a life free from the shackles of debt. 💸 The power to rewrite your financial story is right there in your pocket – why wait to turn the page to that debt-free chapter? 📘💫

Secure Your Future with Easy Savings Apps 💰

Imagine turning your smartphone into a piggy bank, but one that grows without you having to drop in coins every day. That’s what modern savings apps are like, quietly and efficiently putting money aside for you so that you can sip a cup of coffee without worry. They often come with smart features that figure out just how much you can save without stretching your wallet too thin. So, whether it’s for an emergency fund 🚑, a dream vacation ✈️, or just a financial cushion, these apps help you set and hit those savings goals without needing a finance degree.

What’s more, many of these apps get creative, turning saving from a chore into a fun game. Tables charting your progress can make saving as satisfying as checking off a to-do list. Consider this:

| App Name | Key Feature | User-Friendly Scale (1-5) |

|---|---|---|

| SaveMate | Automatic daily/weekly/monthly saving | 5 |

| GoalGetter | Personalized saving goals with visual tracking | 4 |

| FrugalFriend | Rounds up purchases to save the change | 4 |

This table shows a glimpse of what’s out there waiting for you. Pick one, get started, and watch your savings bloom 💐. It’s all about making saving so simple and habitual that your future self will thank you for being such a forward-thinking financial gardener.

Stay Safe: Top Apps for Financial Privacy 🔒

In today’s world where every tap and click could potentially expose your financial life to the lurking eyes of cyber bandits, keeping your money matters private is as vital as the air we breathe. Imagine an app that acts like a digital vault 🏦, guarding your personal finance data with layers of security that rival those of a high-tech bank. It’s like having a personal bodyguard for your bank account – one that doesn’t take coffee breaks or sleep. Such apps use end-to-end encryption and sometimes biometric locks – think fingerprint or face recognition 🤖 – to ensure that only you have the key to your financial kingdom. They help you sleep soundly, knowing your sensitive account details aren’t just floating around on the internet for anyone to grab. Beyond encryption, some apps even offer anonymous payment options and virtual cards, so you can wave goodbye 👋 to the worry of your spending habits or personal information being tracked. These financial fortresses don’t just protect you from external threats; they’re also designed to keep you safe from those ‘oops’ moments where you might accidentally share too much. With features allowing you to control exactly who sees what, you’re the master of your money and your privacy. And the peace of mind this brings? Well, that’s just priceless.