- Unlock Financial Freedom with Budget Trackers 🚀

- Invest Smartly Anywhere with Mobile Investing Apps 📈

- Daily Expenses at a Glance with Spending Monitors 💳

- Save Without Effort Using Automated Savings Apps 🐷

- Crush Debt with Innovative Debt Management Tools 🛠️

- Stay Secure and Alert with Fraud Protection Apps 🔒

Table of Contents

ToggleUnlock Financial Freedom with Budget Trackers 🚀

Imagine waking up each morning feeling like the captain of your own financial ship. With simple yet powerful budget trackers, you embark on a journey towards money mastery. Picture a little digital helper, right in your pocket, that watches over your earnings and spending, turning the complex tides of finance into a breezy sail. These apps show you where your money is going with easy-to-understand charts and graphs that can make even the budget-shy say, “Aha, I get it now!” 🚀💡

Gone are the days of surprise expenses leaping out of concealed corners. By entering your earnings and noting down what you spend, even those innocent-looking morning coffees, you’ll begin to notice patterns. Perhaps you’ll find that casual dining is gobbling up more of your paycheck than you realized, or that you’re actually a wizard at saving on groceries. These insights empower you to make small changes that stack up to big savings. Plus, set your financial goals, and watch yourself soar towards them, all while keeping your feet firmly planted in the present. 🎯💪

| Feature | Description |

|---|---|

| Earnings Tracking | Keep an eye on what’s coming in so you never lose sight of your resources. |

| Spending Patterns | Discover where every penny goes, and uncover hidden spending habits. |

| Goal Setting | Specify your financial targets and track your progress effortlessly. |

| Alerts & Reminders | Get nudges for bill payments and other important money matters. |

Prepare to wave goodbye to the stress of unopened bills and the confusion over where your hard-earned money vanishes. Embrace these digital companions and join countless others who’ve charted their course to financial freedom. Let’s make this year the one where your budget starts working for you, not against you.

Invest Smartly Anywhere with Mobile Investing Apps 📈

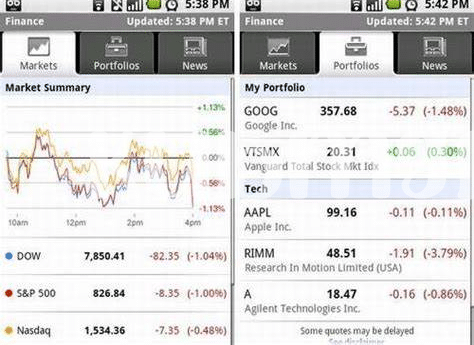

Gone are the days when you had to sit in front of a big, clunky computer to figure out where to put your hard-earned cash. Nowadays, the power is right in your pocket. 📈 With user-friendly apps on your phone, you can jump into the world of investing from wherever you might be; whether you’re sipping coffee in a café or taking a break at work. These nifty tools let you peek at how stocks are doing, learn about markets, and even buy or sell shares with just a few taps. Imagine growing your savings while waiting in line at the grocery store! And it’s not just for pros, either—these apps are built for everyone, whether you’re a newbie or a seasoned investor. They’re about taking the mystery out of money, helping you make decisions that feel right for you. Plus, with features like automatic investment plans, you can put your investment journey on autopilot, slowly building your future with consistency. 🐷 And since we’re talking about growing your own personal wealth, remember to keep your ears open for the coolest tunes with the best free android music app in 2024 to keep your investing experience upbeat. When it comes to your finances, it’s all about staying connected, informed, and ready to make moves when the time is right. Keep those apps close and watch your money work for you! 🔒

Daily Expenses at a Glance with Spending Monitors 💳

Imagine effortlessly tracking where every penny of your hard-earned cash is going, giving you a crystal clear picture of your financial journey each day. This peace of mind is exactly what spending monitors offer. 🎯 They act like your personal finance detectives, always on the lookout, ensuring not a single transaction slips by unnoticed. With vivid charts and friendly notifications 📊✉️, you’re no longer playing a guessing game with your bank statements — you’ll see your coffee shop visits, weekly groceries, or even the odd impulse buy, all neatly lined up. The beauty of these apps lies in their simplicity; they quietly work in the background, categorizing your purchases, spotting trends, and helping you make sense of your spending in real time. 💡 Whether it’s spotting areas where you can cut back, or just reassuring you that you’re on the right track, these monitors transform numbers and receipts into actionable insights to help you spend smarter. It’s like having a financial ally right in your pocket, cheering you on as you take control of today’s spending, laying a stronger foundation for tomorrow’s dreams.

Save Without Effort Using Automated Savings Apps 🐷

Imagine this: your savings growing while you sleep, eat, or even as you spend. It’s not magic, it’s technology! 🎩✨ Automated savings apps are like clever little robots tucked away in your phone, working tirelessly to help you put some money aside. They link up to your bank account and follow rules you set to move small amounts of money into a savings account. You won’t even notice it’s happening, but over time, these little contributions can add up to a sizeable nest egg!

It’s like having a silent partner in your financial journey who’s always looking out for you, nudging you to save by turning spare change from daily purchases into future wealth. These apps often use fun ways to save, like rounding up to the nearest dollar when you buy coffee and setting aside the difference 🍵. It’s a sneaky and painless way to save without having to think about it.

Considering how we love our phones and apps, it’s cool that now our tech can help us get ahead with our money goals. And speaking of great app finds, if you’re in search of entertainment, what is the best free android in 2024 updated music app? That’s another way your smartphone can enrich your life, without spending a dime!

So why wait? Start turning your digital pennies into digital piggy banks and watch your savings soar to new heights 🚀🐷. With automated savings apps, you’re always one step closer to your dreams, even if you’re just out for a walk or watching TV. It’s your financial growth, on autopilot.

Crush Debt with Innovative Debt Management Tools 🛠️

Imagine sailing into a calm harbor after battling the high seas of debt – that’s what modern tools can do for your finances. With the right app in your pocket, you can break down those towering debts into manageable pieces. These smart tools often come with dashboards that show you the big picture: what you owe, to whom, and the progress you’re making with each payment. They can also throw a lifeline by suggesting the best debt payoff methods customized to your situation, like the snowball or avalanche methods, turning what seems like an endless cycle into a winnable game. 🛠️

Interactive features can help you find extra money in your budget to pay down your debts faster. Some apps even offer alerts to remind you of due dates, helping you dodge those pesky late fees that can add up over time. 📆 They say knowledge is power, and in the realm of debt, understanding your habits is key. With insights and breakdowns of your spending, you’ll find those “aha” moments that could lead to further savings. Think of these apps as your personal debt coaches, cheering you on and providing strategies every step of the way until you’re free from the chains of debt and basking in the glory of financial freedom. 🔥

Here’s a quick look at how such an app might help you manage your debts:

| Feature | Description |

|---|---|

| Debt Overview | See all your debts in one place and monitor your payoff progress. |

| Payment Strategies | Get personalized advice on which debts to tackle first. |

| Payment Reminders | Never miss a due date with timely alerts. |

| Spending Insights | Analyze your spending and find ways to allocate more to debt reduction. |

Stay Secure and Alert with Fraud Protection Apps 🔒

In today’s digital playground, keeping your money safe is a lot like being a goalkeeper; you need quick reflexes and the right strategy. That’s where the magic of fraud protection apps comes into play. Imagine having a personal finance bodyguard that watches over your transactions day and night, always on high alert to block any sneaky moves that could lead to money loss or identity theft. These apps are your financial defenders, equipped with the latest tech to spot anything unusual. They’ll ping you with a notification faster than you can say “not on my watch” if something doesn’t look right.

These guardians of your wallet go the extra mile. They’re like having a detective for your dollars, constantly scanning the vast virtual world for signs of trouble, such as odd charges or suspicious activity. 🕵️♂️🔍 And because they’re on your phone, you’re in control, no matter where you are or what you’re doing. Whether you’re sipping coffee or hiking up a mountain, you can take a glance and feel relieved knowing that if a bad guy tries to make a move, you’ll have the power to stop them in their tracks. So, with these apps, it’s not just about staying alert; it’s about being empowered to protect your hard-earned money with a tap and a swipe. 💪📱