- Embrace Digital Wallets: a Game Changer 📲

- Track Expenses on the Go with Apps 💸

- Automate and Simplify Bill Payments 🧾

- Security First: Protecting Your Financial Data 🔒

- Sync Your Accounts Seamlessly with Technology 🔄

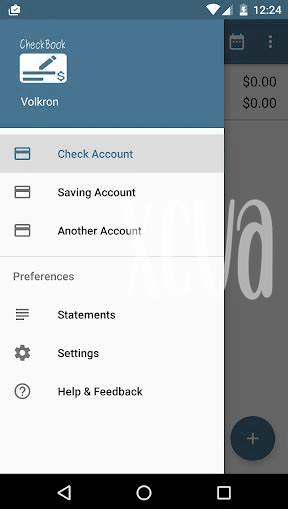

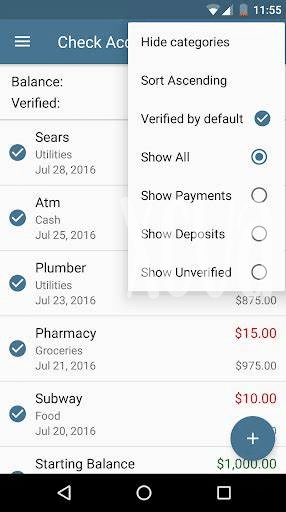

- Choose Wisely: Top Checkbook Apps Reviewed 🏆

Table of Contents

ToggleEmbrace Digital Wallets: a Game Changer 📲

Imagine saying goodbye to that old leather wallet crammed with cards and receipts, and instead, managing all your money with a few taps on your phone. That’s the beauty of digital wallets—they’re like having a financial assistant in your pocket. Picture checking out at the grocery store with a quick scan of your phone—no more fumbling for cash or cards! 🛒 And when you’re out and about, these wallets are so handy for keeping track of all your expenses with ease. You’re at dinner with friends, and instead of splitting the bill the old-fashioned way, you all just tap, pay, and are on your way—simple and social. 🍽️ Plus, there’s no need to fear if you tend to have weak hands when the markets dip; with these apps, some even allow you to HODL your investments, keeping everything in one place until the markets begin to recover. 📉

But it’s not just about convenience; security is top-of-mind too. The digital era may bring stories of people getting rekt by hackers, but the truth is, today’s digital wallets prioritize your privacy and security, using high-tech solutions to keep your data safer than ever.

Take a look at this comparison of some popular digital wallet apps:

| App Name | Key Features | User Experience | Security |

|---|---|---|---|

| PaySmart | Instant payments, expense tracking | Intuitive, user-friendly | Biometric login, encryption |

| MoneyGuard | Budgeting, bill splitting | Easy navigation | Two-factor authentication |

| WalletWise | Investment tracking, loyalty cards | Clean design, engaging interface | End-to-end encryption, fraud alerts |

In the age where everything is going digital, it makes sense that the way we manage our finances evolves too. Join the legions of folks who are flipping tehir wallets for their phones, and watch how managing money becomes a piece of cake. 📱 Remember, a little bit of tech can go a long way in giving you that financial peace of mind. And isn’t that what we all want at the end of the day?

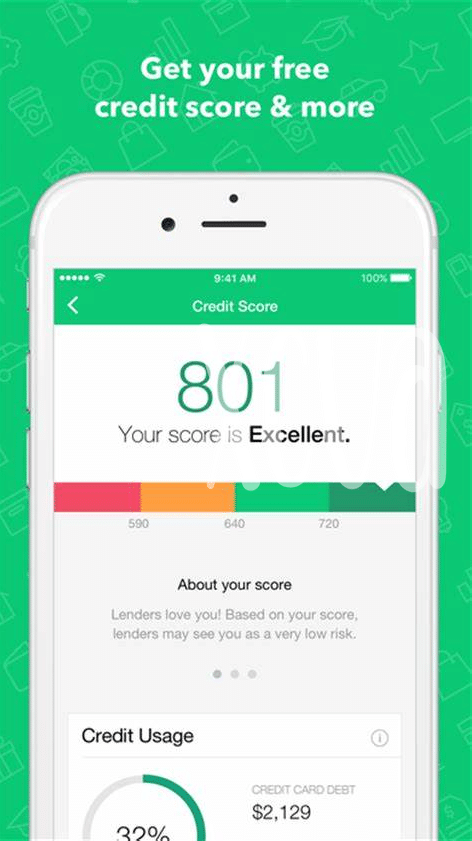

Track Expenses on the Go with Apps 💸

Embracing the digital age means enjoying the luxury of managing your money right at your fingertips. With a plethora of apps designed to make financial tracking as easy as breathing, you can watch your earnings and spendings with minimal fuss. Imagine going on a shopping spree and, with a few taps, knowing exactly how much you have left in your budget. This freedom is not just convenient; it’s empowering! But remember, while you indulge in the ease of these apps, you don’t want to become a ‘bagholder’ stuck with unnecessary expenses. It’s all about making savvy decisions, keeping an eye out for those sales, and maybe, just occasionally, BTD when that perfect deal comes along.

When it’s time to pay the bills, gone are the days of manually ticking off lists or forgetting due dates. Modern checkbook apps bring automation to your doorstep, trimming down your to-do list. But, with great power comes great responsibility—especially when dealing with money. This is where security steps in. Top-tier apps are equipped with robust safeguards to give you peace of mind. Let your funds flow from one account to the other, securely encapsulated within a digital fortress. And while staying secure, remember to stay informed! Not sure about an app? Dive into reviews like “what is the best radar detector app for android 2024 top 5 apps updated” to ensure you’re downloading the creme de la creme. Because just like in life, when it comes to finances, it’s about moving forward with the confidence that you’re on the right path—a path that’s clear, uncomplicated and accessible right from your Android device.

Automate and Simplify Bill Payments 🧾

Keeping up with bills can feel like a juggling act, but it doesn’t have to be. Imagine cutting down on time spent sorting through bills and making sure everything’s paid on time. That’s where smart apps come into play, transforming your smartphone into a central hub for all your payment needs. With a few taps, these clever tools can take over, keeping track of when each bill is due and how much you owe. They usually have features like reminders and automatic scheduling that make sure you never miss a payment again. This not only saves time but can also save money in late fees and added interest.

Picture this: every month, as bills start filling up your mailbox, your phone already knows what’s coming. Before a worry can crease your forehead, your app has organized it all. Automated payments mean you’re always on time. Plus, many apps now go the extra mile by crunching the numbers for you, providing insights into where your hard-earned cash is going. And let’s face it, watching your bills pay themselves is a little bit like magic. 🧙♂️✨ Imagine avoiding the scenario of becoming a ‘bagholder’ with outstanding dues because the app has seamlessly managed it all for you. Embracing such technology not only elevates your finance game but also grants peace of mind – and that’s priceless. 🛡️💖 Now that’s smart management – without needing to be a math whiz or a calendar keeper. So take back your time and let automation do the heavy lifting. With these apps, say goodbye to last-minute rushes and hello to more ‘me time’. Just set it up, and you’re golden.

Security First: Protecting Your Financial Data 🔒

When it comes to keeping tabs on our financial activities through our phones, tossing caution to the wind isn’t an option. Imagine you’re mooning over the convenience of digital transactions, and then, out of the blue, you get rekt – not because the markets went south, but because some sneaky hacker found a crack in your app’s armor. That’s a scenario no one wants, right? Just like how we lock up our homes and cars, our virtual wallets demand robust security measures. We’re talking multiple layers of protection like encryption, two-factor authentication, and real-time alerts. Remember, in the vast sea of digital transactions, even the sharks – the whales of the cyber world – are on the lookout for vulnerable prey. So, whether you’ve got diamond hands holding on to your investments or you’re more of a normie to the digital finance world, it’s crucial to safeguard your hard-earned money. Think about this too – when you automate your finances, you’re essentially giving an app the keys to your bank vault. That’s a big deal, and you want to be sure that these apps are not only handy but as safe as houses. Now, most top-notch checkbook apps will put security on a pedestal, giving you fewer FUD moments to sweat over. But remember, security isn’t just about the app; it’s also about keeping your devices secure and your personal access codes secret, to avoid the unpleasent experience of cryptojacking. Got more questions on how to stay safe while keeping your finances sleek and streamlined? For answers, and if you’re wondering what is the best radar detector app for android 2024 top 5 apps updated, click through for some insights. It’s not just about tracking those budgetary blips, but about cruising through your financial life with the right safeguards bolted in place.

Sync Your Accounts Seamlessly with Technology 🔄

Imagine waking up one sunny morning, bursting with that “LFG” excitement because you’ve finally decided to take control of your financial life. 💪 That’s where the magic of today’s tech-savvy world comes in, turning what was once a tedious task into smooth sailing. By using the right app, all your bank accounts, from that old college savings account to your shiny new digital wallet, can now talk to each other in perfect harmony. It’s like having a financial translator at your fingertips, breaking down the walls between different banks and financial institutions.

| Features | Benefits |

|---|---|

| Real-time updates | Stay informed on-the-fly |

| Multi-account overview | Everything in one place |

| Secure encryption | Peace of mind for your data |

| Automatic categorization | Effortlessly manage expenses |

Amidst adopting this life-changing tool, it’s crucial to remain grounded. Remember, with great power comes great responsibility. Avoid the trap of becoming a “bagholder” with outdated financial habits, and instead, step into the age where you can observe every transaction, recognize trends, and make informed decisions. Picture this: a single tap and you know exactly where your money is moving. No more guessing games or scrabbling around for forgotten passwords. Just the confident, calm air of someone with “diamond hands” in the finance world. Sure, little hiccups will happen—a slip of the finger here, a tyop there (like ‘definately’ instead of ‘definitely’)—but the streamlined convenience can’t be beaten. Rejoice, for the days of financial fog are behind you, and the dawn of clarity is here. 🌟🚀

Choose Wisely: Top Checkbook Apps Reviewed 🏆

When it comes to managing your money, the right checkbook app can feel like a financial fairy godmother. It’s like having a tiny accountant in your pocket, always ready to tell you how much you’ve spent on lattes this month. Now, there are a ton of options out there, and sifting through them can feel a bit like trying to find a needle in a haystack. But don’t worry, we’ve done some of the legwork for you.

Think of these apps as your money’s new best friends. They’re smart, they’re intuitive, and they don’t judge you for that impulse shoe purchase last weekend. Some of them even make it fun to keep track of your pennies. They let you categorize your expenses, see pretty charts of your spending habits, and some might even nudge you with a notification when it’s time to avoid being a bagholder of unnecessary subscriptions.

While security is key, because nobody wants to deal with the headache of a digital pickpocket, these apps have got you covered. BTD if your finances seem too daunting, remember these apps come equipped with alerts and reminders, so you’ll keep up on bills like a pro. Coining smooth navigation and user-friendly interfaces, they’re perfect for anyone who gets a bit of cryptosis when looking at spreadsheets.

Choosing the right app is about finding balance – it should be powerful enough to handle all your finance needs but simple enough that you don’t need a finance degree to use it. We’ve looked at various factors like ease of use, features, and user reviews to come up with a champion lineup. So whether you’re looking to get a grip on your spending, ensure you’re never late on a bill again, or just want to make sure your finance game is strong, there’s an app on our list that’s tailor-made for your wallet. And yes, we promise, no cryptojacking involved. So take the plunge, without the fear of total financial wipeouts or FOMO, because these apps are the real deal and ready to help you take charge of your cash flow. Just remember to DYOR on each app to find the perfect fit for your financial journey.