- Swipe Your Way to Savvy Spending 📊

- Alerts That Save You from Late Fees ⏰

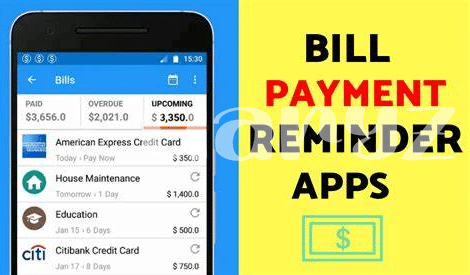

- Organizing Bills with a Tap 🗂️

- Sync Up: Never Miss a Payment Date 🔄

- Custom Reminders for Your Financial Peace ✍️

- Analyze and Conquer Your Bills 💡

Table of Contents

ToggleSwipe Your Way to Savvy Spending 📊

Imagine you’re staring at your phone, and with a simple swipe, you feel like a money wizard. That’s the magic of these clever Android bill reminder apps. They take the mess of numbers, due dates, and amounts and turn it into a visual feast. With a swipe here and a tap there, you can check out your expenses in a way that makes sense. And it’s not just about looking at pretty pie charts; it’s about understanding where your money is going, so you can make smarter choices. Imagine knowing you’ve got your coffee habit under control, or that last month’s shopping spree was a one-off blip, not a budget buster.

This kind of clarity can change the way you spend and save. Let’s take a deeper dive into how these apps make managing money feel like a breeze. The ease of swiping through your expenses gives you the power to spot trends. Are you spending more on eating out than you realized? A quick glance and a swipe can tell you. And these aren’t just dry numbers; they’re your financial story being told in colorful graphs and easy-to-read tables. Take a look at this clear breakdown to see what we mean:

“`html

| Category | Expense | % of Total |

|---|---|---|

| Groceries | $500 | 25% |

| Rent/Mortgage | $1000 | 50% |

| Entertainment | $200 | 10% |

| Utilities | $300 | 15% |

“`

With everything laid out in front of you 📊, you can decide to dial back a bit on entertainment or see if there’s a way to shave down those utility bills ⚡. It’s like having a financial coach in your pocket that’s helping you stay on track without any finger-wagging lectures. Just swipe, tap, and take control 🎮.

Alerts That Save You from Late Fees ⏰

Picture this: You’re deep in your favorite album when a notification pops up, gently reminding you that it’s time to pay the water bill. It’s a lifesaver, right? With the hustle and bustle of everyday life, it’s easy for such things to slip right past us. Thankfully, Android bill reminder apps are here, transforming our smartphones into personal finance assistants. These nifty apps send you notifications before your bills are due. Just imagine the relief of no more panic attacks after realizing you’ve accidentally skipped a payment. Say goodbye to the dread of late fees eating away at your hard-earned money – a thing of the past with these clever little digital guardians.

Moreover, in a world where every penny counts, these apps aren’t just about avoiding unnecessary charges. They empower you to take control of your finances by keeping them right at the forefront of your mind. Just like how you’ve got a tool to keep your tunes in check – wondering what is the best music downloader app for android 2024 top 5 apps updated? – you’ve now got a way to ensure your bills are paid on time, every time. Customizable alerts mean you can set them to suit your schedule, reminding you at the optimum time to part with your cash, ensuring your financial peace remains undisturbed. It’s like having a personal accountant in your pocket, nudging you to spend wisely and save smart. 🌟📲👍

Organizing Bills with a Tap 🗂️

Picture this: You’ve got a stack of bills, a cluttered desk, and a headache brewing. Now, imagine turning that chaos into calm with just a tap on your phone. That’s right – modern bill reminder apps for Android are like having a personal assistant in your pocket. 📲 Suddenly, all those pieces of paper transform into neat digital files. You can categorize each bill by type, whether it’s utilities, credit cards, or that gym membership you keep meaning to use. And just like that, you’re not just paying bills, but managing them like a pro.

With these apps, you’re not shuffling through drawers or worrying about misplacing an important bill; everything is right where it should be. Tap on the screen, and voilà, you can see exactly what’s coming up, how much you owe, and even attach receipts or notes to keep everything in order. It’s like having a tidy filing cabinet without the bulk – your documents are secure and retrievable in a snap. 📂🔒

And there’s more—they even let you share access with a partner or family member, making sure everyone’s on the same page. No more nagging or guesswork, just a shared understanding and a smooth-running finance management train. Efficiency jumps up a level, and suddenly, those Sunday nights spent sorting through paper slips are a thing of the past. Who knew a single tap could do all that? Your Android device just became the ultimate tool in shaping up your financial life. 💡

Sync Up: Never Miss a Payment Date 🔄

Imagine setting a date with your hard-earned cash every month. It’s about maintaining a blossoming relationship with your bank balance, where keeping track of every ‘date’ plays the cupid in your financial love story. These clever Android apps are like your trustworthy friends, who remind you it’s time to pay the electricity bill or that your credit card due date is waving hello. With a few clicks, these applications synchronize all your payment deadlines in one place. 🔄 Like magic, your smartphone becomes a timekeeper for each dollar that needs to leave your wallet.

While you’re appreciating the wondrous world of convenient bill management, don’t forget to treat your ears to the best tunes. Finding the perfect soundtrack for managing your finances can be just as satisfying as hitting that ‘paid’ button on time. And music lovers, you’re in luck! For auditory bliss, check out what is the best music downloader app for android 2024 top 5 apps updated to find the ideal melodies to accompany your bill-paying sessions. This sense of control and organization isn’t limited to your bills; sync your life’s rhythm with some good tunes, and you’ll dance through your to-dos with a spring in your step. 🎶💃

Custom Reminders for Your Financial Peace ✍️

Imagine a tiny, personalized coach living in your phone, one that knows your financial habits better than you know them yourself. This coach isn’t here to scold you; instead, it gently nudges you with bespoke notifications designed to align perfectly with your lifestyle and financial goals. Whether it’s reminding you to save a little extra for that upcoming holiday or nudging you to pay the electricity bill on the 14th of every month, these digital helpers turn the often daunting task of bill management into a breezy, stress-free process. They adapt to your schedule, making sure that no two reminders are the same, because no two days of your life are identical. This level of personalization ensures that you’re in tune with your financial obligations, making peace of mind your default state rather than an occasional visitor.

Let’s break down just how these tailored nudges help keep your finances in check. Picture this: it’s the end of the month, and bills are coming in fast, but thanks to your trusty app, each due date is accounted for with a unique alert. You’ve set up a reminder for the credit card bill two days before it’s due, so you can always pay in full and avoid interest. Your utility bills get a separate treatment – a reminder the day before, because you know that’s when you do your online banking. It’s like having an arsenal of sticky notes, but smarter and always in your pocket. Below is a neat table illustrating the types of personalized reminders you can set:

| Bill Type | Reminder Time | Personal Touch |

|---|---|---|

| Credit Card | 2 days before due date | Set reminder after payday |

| Utilities | 1 day before due date | Evening alert – aligns with online banking routine |

| Rent | First day of the month | Morning reminder – start the month stress-free |

This personalized system doesn’t just remind you to pay; it adapts to your financial ebb and flow, turning what used to be a hectic scramble into a harmonious dance with your budget. These reminders serve as your silent financial guardians, ensuring that everything is paid on time and you can rest easy knowing your finances are under control. 📅✅💸

Analyze and Conquer Your Bills 💡

Gone are the days of being blindsided by a stack of bills or feeling puzzled about where your money goes each month. Imagine having your own personal finance assistant right in your pocket, transforming your smartphone into a powerful tool for financial management. With intuitive bill reminder apps on your Android device, the power to dissect your expenses is at your fingertips. 🧐 By categorizing your payments and tracking where each penny is destined, these apps help bring transparency to your monetary flow. They often include visually engaging charts and graphs, allowing you to view your spending patterns over time. This clarity can be incredibly empowering, assisting you in making informed decisions to trim excess spending and bolster your savings.

Additionally, these apps shine a spotlight on recurring charges that might have slipped under your radar, like that magazine subscription you forgot to cancel. 🕵️♂️ By pinpointing these sneaky expenditures, you can decide whether they’re really worth your hard-earned cash. Armed with this newfound knowledge, setting up a game plan becomes that much easier. It’s all about taking control and making your money work for you. So, with each alert and analysis, these bill reminder apps aren’t just about avoiding late fees; they’re about equipping you with the insights to effectively conquer your bills and step into a brighter financial future. 💪