- Kickstart Your Savings with the Right App 🚀

- Track Every Penny: Popular Expense Trackers 🧐

- Personalize Your Budget: Customizable App Features 🎨

- Get Bill Smart: Apps That Manage Recurring Payments 💡

- Syncing Your Money: Multi-device Friendly Apps 🔗

- Safe and Secure: Privacy Features Examined 🔒

Table of Contents

ToggleKickstart Your Savings with the Right App 🚀

Finding the perfect app to nurture your nest egg is like grabbing a surfboard to ride the wave of savings 🏄♂️. Imagine an app that fits into your financial life as snugly as your favorite pair of jeans. It’s about understanding the ebb and flow of your money – from your morning coffee to that end-of-month rent payment. With crystal-clear categories for your spending and saving goals, these digital tools help transform your financial chaos into a well-oiled machine that works for you.

| App Features | Description |

|---|---|

| User-friendly Interface | Simple, intuitive navigation to keep your financial planning on track without the headache. |

| Goal-setting Tools | Champion your savings by setting and hitting targets tailored to your dreams and desires. |

| Progress Tracking | Visually track your journey, sprinkling a little FOMO for that extra push to skip the unnecessary splurge. |

These aren’t just apps; they’re your personal finance gurus sitting snug in your pocket, ready to guide you away from being a bagholder in your own life. With their guidance, you might just find yourself with diamond hands in your savings strategy, holding onto your wealth and watching it grow, bump by bump, as you navigate the financial tides ahead. 🌊💎

Track Every Penny: Popular Expense Trackers 🧐

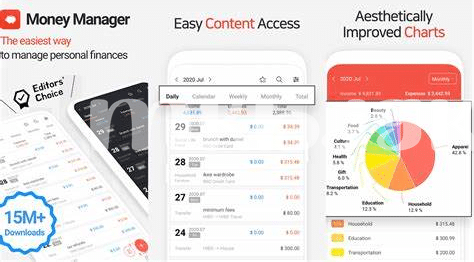

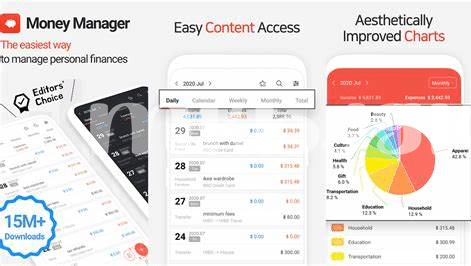

Gone are the days of poring over bank statements and guessing where your cash has trickled away. The digital era has handed us keys to the kingdom of financial awareness, and it comes in the form of nifty expense trackers. Imagine having a smart companion nestled in your Android device that eyes every transaction with hawk-like precision. These apps act as both a financial adviser and an eagle-eyed accountant, ensuring you don’t accidentally become a bagholder of unnecessary expenses. They also offer the thrill of watching your savings balloon up—sans the FOMO from frivolous spending.

While some of us HODL onto receipts from months ago, these apps can liberate you from that clutter and give you real-time insights into your financial health, enabling you to ‘buy the dip’ when your expenses swell past your comfort zone. With charts, graphs, and custom notifications, you’re empowered with knowledge previously known only to the savviest of spenders. It’s like having diamond hands for your cash; you control when to hold tight and when to let go, making these apps the unsung heroes in your digital financial arsenal.

Personalize Your Budget: Customizable App Features 🎨

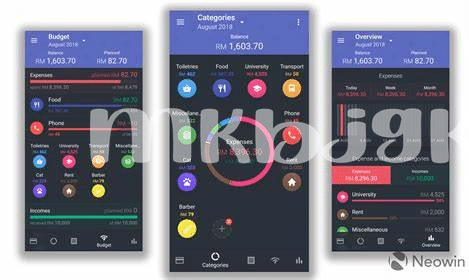

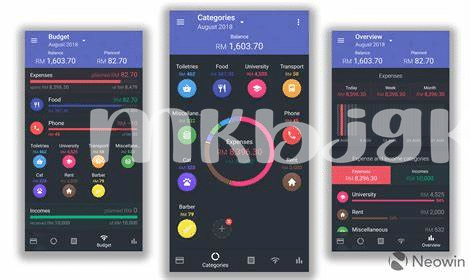

Imagine having a financial companion right on your iPhone or iPad, one that dances to the rhythm of your life. That’s the magic of modern budgeting apps. These nifty tools understand that each of us has unique spending habits and financial goals. 🎨 With a few taps, you can tweak these apps to mirror your own money matters. Whether you’re a thrifty saver or a bit of a spendthrift, customization is key. You might want to set specific savings targets, like for a new bike, or keep an eye on that pesky urge to splurge after each paycheck – admit it, we’ve all been there with a bit of FOMO on the latest gadgets or fashion trends.

The beauty lies in the details. You can create categories for every type of expense or even tag the transactions like “groceries,” “rent,” or the occasional “treat yourself” coffee. 🧐 Personalization makes it easier to stick to your budget because it’s tailored to you, not some generic template. It’s like your financial fingerprint, unique and distinct. Even better, these apps can grow with you. As your financial savvy strengthens, perhaps you’ll transition from someone with ‘weak hands,’ easily rattled by unexpected costs, to boasting those sought-after ‘diamond hands,’ unshaken by life’s financial ebbs and flows. Ready for every twist and turn, customizable budgeting apps don’t just track your dollars; they adapt to your dreams. 🔗 So what’s stopping you? Dive in, tailor away, and watch your financial control soar to the moon.

Get Bill Smart: Apps That Manage Recurring Payments 💡

Bills, the monthly subscriptions, and the various regular payments can sneak up on you, but fear not! There are some stellar Android apps that help you stay on top of it all. Imagine having a personal finance advisor in your pocket, always keeping an eagle eye on your ongoing expenses. These apps aren’t just glorified calculators; they are your financial planners, ensuring you’re not caught off-guard when bills roll in. They categorize your expenses, so there’s no mix-up between your gym membership and your streaming services – making sure your hard-earned cash is always in check. 💡

Maintaining an overview of recurring payments means you won’t end up as a bagholder, stuck with subscriptions you’ve forgotten about as they drain your account. Plus, some apps also offer friendly reminders before each bill is due, nudging you that it’s time to BTD, or ‘buy the dip’, on your monthly expenses. And because security should never be an afterthought, especially when handling financial data, you might wonder, what is the best android app for removing trojans? It’s essential to couple your budgeting app with robust security software, keeping your financial information away from prying eyes and ensuring peace of mind. 🔒🔗

Syncing Your Money: Multi-device Friendly Apps 🔗

Imagine a world where your piggy bank lives on all your devices, always ready for you to feed it, no matter where you are. That’s what multi-device friendly budgeting apps do; they’re like having a financial buddy in your pocket, on your tablet, and on your computer all at once. 🎯 Whether you’re catching some sun at the beach or chilling at a café, updating your expenses is a breeze. You could be buying the dip on a hot investment from your phone and later, crunching numbers on your laptop with all the updates neatly synced. No more messy transferring of info or outdated numbers causing a headache. It’s a smooth, real-time collaboration between all your gadgets, ensuring your numbers are always fresh and ready for action.

Now let’s look at a table that makes it crystal clear why syncing across devices can make all the difference in staying on top of your finances:

| Device Synchronization | Advantages |

|---|---|

| On-the-go updates | Make changes from any device and have them reflect everywhere instantly. |

| Consistent overview | Avoid discrepancies and keep a unified financial picture. |

| Backup and security | Multiple devices mean your data is safe, even if one device is lost or compromised. |

Protected by robust security measures, these apps are your fortress against FOMO-triggered bad choices, keeping your finances steady while you stay updated on every front. No normie approach here; you’re in control like a true whale, commanding your budget with an eagle’s eye view across the sea of numbers—and all without ever breaking a sweat. 🔐💼

Safe and Secure: Privacy Features Examined 🔒

In the digital era, where our financial footprints extend far beyond physical wallets, finding a haven for your funds is paramount. Imagine you’re dipping your toes for the first time into managing your money with an app; you want the waters to be as clear and as secure as possible. It’s not just about watching your bags grow; it’s about knowing that no one else can take a sneak peek or, worse, take off with them. The best budgeting apps come armored with robust privacy features, making sure that your details stay between you and your screen. Think of these apps as having diamond hands when it comes to protecting your information—they’re not selling you out or running off (no rug pulls here!). They employ encryption heavyweights, the digital equivalent of a vault, and perform regular security check-ups to keep cryptojackers at bay. And for the more privacy-conscious, these apps often allow for custom security settings, empowering you with the vigilance of a Bitcoin Maximalist without the need for constant cryptosis. Emojis for coins may well represent real money in the app world, but rest assured, these apps understand the assignment—keeping your hard-earned money as safe as if it’s snug underneath your mattress, yet wisely working for you. 🛡️🔍💰