- Unveiling the Contenders: Top Apps Compared 🏆

- Speedy Transactions: Which App Delivers Fast? ⚡

- Keeping Your Money Safe: Security Features 🔒

- Minimal Fees, Maximum Savings: Cost Analysis 💸

- User-friendly Designs: Navigating with Ease 📱

- Multipurpose Use: More Than Just Cash Transfer 🛠️

Table of Contents

ToggleUnveiling the Contenders: Top Apps Compared 🏆

Imagine stepping into a digital arena where only the best warriors of finance battle it out for the top spot. In one corner, we have PayPal, the veteran, with its massive user base and robust features. It’s the familiar face that has been around the block, earning trust through years of reliable service. Facing off against this giant is Google’s own champion, Google Pay, a contender known for its seamless integration with Android devices and a smooth experience.

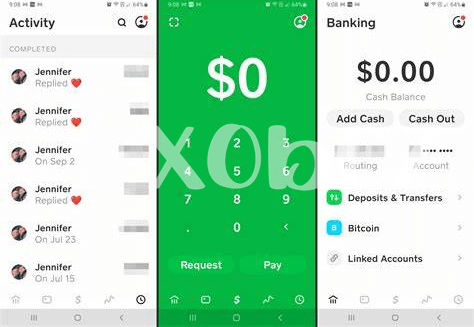

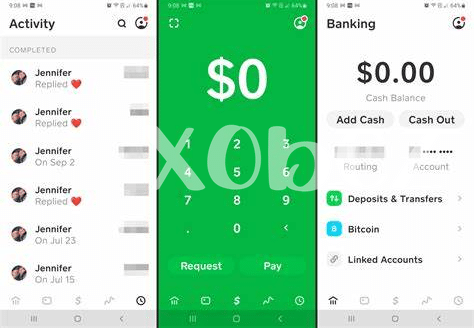

But the competition doesn’t end there. Up comes Venmo, swinging with its social savviness and ease of splitting bills among friends. And we can’t overlook Cash App, with a growing fan base of its own, thanks to its unique offerings like investing in stocks and Bitcoin transactions. Each of these apps brings their own mix of convenience, features, and perks to the table, ensuring that the fight for your finances is fiercely waged.

Now, let’s lay out these contenders side by side in a showdown of functionality and flair:

| App Name | Popularity | Unique Features | Integration Level |

|---|---|---|---|

| PayPal | Widely Used | Extensive global reach, buyer protection | High, with various platforms |

| Google Pay | Popular among Android users | Tight integration with Android, offers and rewards | Very High, with Google services |

| Venmo | Popular with millennials | Social media component, simple UI | Medium, mainly peer-to-peer focused |

| Cash App | Rising popularity | Investment options, Bitcoin transactions | Medium, expanding services |

Now that we’ve met our gladiators in this financial coliseum, it’s time to dive deeper and discover who truly reigns supreme for Android enthusiasts looking to manage their money with ease. 💳📈🏦

Speedy Transactions: Which App Delivers Fast? ⚡

When it comes to managing your finances on the go, the speed at which you can move your money matters just as much as the amount you’re transferring. Imagine you’re settling a dinner bill, and right there, as you tap your phone screen, your portion zips back to your friend’s account before they’ve even slipped their card back into their wallet. That’s the sort of lightning-fast service modern Android users are seeking. And within the tech-savvy landscape of cash apps, a few stand out for their ability to make transactions feel almost instantaneous. ⚡️🚀

These apps aren’t just about sending cash; they’re about keeping life moving without the drag of unnecessary delay. You might need to split a bill, share rent with roommates, or pay for that secondhand bike you bought through an online marketplace. Timing can be crucial, especially if you’re in a rush. So, analyzing these apps, we look at things like transaction speeds under various conditions, network reliability, and whether the app employs clever tech to ensure you’re not staring at a loading screen while life passes you by. 🔄

The convenience of quick transactions ties beautifully into the broader ecosystem of streamlined online financial tools. As a side note, those interested in optimizing their digital toolset should also explore other app categories, such as the latest text-to-speech apps. In fact, when you’re done with money transfers, and if you find yourself wondering, what is the best text to speech app for android 2024 top 5 apps updated, you’ll find that some of these handy utilities might just rival the speed and efficiency of the best cash apps for Android users.

Keeping Your Money Safe: Security Features 🔒

When it comes to handling money on your phone, feeling secure is just as important as the phone in your pocket. Imagine a virtual vault, where every penny you add is accounted for and protected; that’s what the best cash apps are striving to provide. 🔒 They layer their systems with top-notch security features like encryption—think of this as a secret code that only you and the app can understand, keeping outsiders confused. Then there’s two-factor authentication, an extra step where the app double-checks it’s really you, like asking for a secret handshake before you enter a clubhouse. 🕵️♂️ Some apps even monitor for dodgy activity around the clock, so you can sleep tight knowing someone is always keeping an eye on your digital dollars. If something does seem a bit off, instant notifications are like a friend tapping you on the shoulder to give you a heads-up; they’re fast, direct, and make sure you’re in the loop. What if you make a mistake, sending money to the wrong person? No sweat! With easy cancellation processes, it’s like having an undo button for your transactions. 💳 Remember, while innovation races on, your peace of mind is worth its weight in gold, so choosing an app with these formidable shields in place is a smart way to stay one step ahead of any mischief-makers out there.

Minimal Fees, Maximum Savings: Cost Analysis 💸

When it comes to handling money, every penny counts – and that’s where choosing the right cash app can make all the difference for Android users. Just like scouting for the best deals at the supermarket, sifting through cash apps is all about finding the ones that let you keep more of your hard-earned cash. Curiously, not all apps are created equal in the garden of savings – some are like bountiful apple trees, offering low to no fees for standard transactions, while others might resemble a thorny bush, hiding fees in the most unexpected places. It’s not just about transfer fees; some apps also charge for instant deposits or currency conversion. So, a little homework can lead to finding an app that aligns with your financial habits, whether you’re sending money weekly to a friend, or just making occasional online purchases. 🌱💼

Just as you might read reviews to discover what is the best text to speech app for android 2024 top 5 apps updated, invest the same energy into comparing cash apps. Think of it as crafting your own financial success story – with a leading character who’s smart and savvy about where they stash their cash. Some apps offer a tiered fee structure, where you get to enjoy more features as you climb up the membership ladder, while others are more straightforward with a flat-rate approach that makes budgeting a breeze. And for those who detest surprises on their statements, there are even options that boast a “no surprise fees” policy. It’s like a treasure hunt, and your prize is keeping more of your money – now who wouldn’t want to embark on that adventure? 🏦✨

User-friendly Designs: Navigating with Ease 📱

When choosing a cash app, it’s like picking out a new pair of shoes; they need to fit right and get you moving without any fuss. Imagine opening up an app where the icons are like friendly street signs, guiding you exactly where you need to go, whether you’re sending cash to a friend or splitting the dinner bill. It’s all about the feel of the app in your hand, how it turns complex tasks into a few simple taps on your screen. 👌👍

Here’s what users are raving about: apps that give you a smooth ride from login to transaction completion without any bumps. You don’t need to be a tech whiz to understand these apps. With layouts clear as a sunlit day, getting your errands done is as easy as pie. The best part? They’re designed with you in mind – adapting to your preferences and learning your habits over time to serve up an experience that’s as personal as your morning coffee. 🌟💡

| Feature | Description |

|---|---|

| One-Touch Login | Get access fast using fingerprints or facial recognition, skipping the hassle of passwords. |

| Intuitive Navigation | Crisp, clear menus and buttons lead you smoothly from one task to the next. |

| Personalized Dashboard | Your frequent transactions and favorite features front and center, saving you time. |

| Help & Support | Trouble? Help is just a tap away with built-in support and easy-to-find contact options. |

Multipurpose Use: More Than Just Cash Transfer 🛠️

When we think about cash apps, it’s easy to focus on the main feature they all share: sending and receiving money. But imagine a Swiss Army knife, but for your finances. That’s what the best cash apps have become—they’re transforming into versatile financial tools right on your Android device. Imagine logging in and finding a budget planner sitting snugly alongside your transaction history, helping you track your spending without switching apps. Some apps even offer investment options, turning your phone into a pocket-sized financial advisor, guiding you on where to put your spare change to work.

🛠️ The little unexpected extras can make all the difference, like reward points for frequent use or discounts with partner retailers that make your money work harder for you. It’s like having a wallet that not only stores your cash but also helps it grow. Picture this: you’re at the coffee shop, and with the same app you paid for your coffee, you earn loyalty points and snag a discount on your next cup—all while setting aside a few pennies into a savings vault. These apps don’t just move your money; they’re gateways to a smarter financial lifestyle, where every transaction can bring added value to your life. So next time you tap to pay, know that your app is more than a digital cashier; it’s a financial companion for your daily journey. 📱💡