- Introducing the Top Checkbook Apps 📱

- User-friendly Interfaces and Features 💼

- Security and Privacy Measures 🔒

- Syncing Capabilities and Integration 🔄

- Cost-effectiveness and Additional Services 💵

- Expert Recommendations and Final Thoughts 🌟

Table of Contents

ToggleIntroducing the Top Checkbook Apps 📱

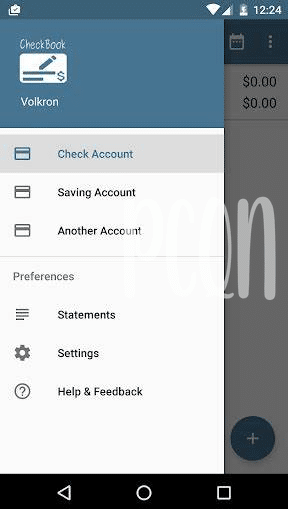

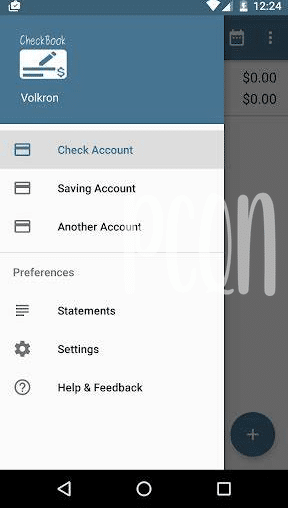

When it comes to managing personal finances on the go, checkbook apps are becoming increasingly popular for Android users. These apps offer a convenient way to track expenses, manage budgets, and monitor transactions, all from the palm of your hand. With a plethora of options available on the Google Play Store, finding the top checkbook apps that suit your specific needs can be a daunting task. To help simplify the selection process, we have curated a list of the most robust and reliable checkbook apps for Android users. Each app offers unique features and functionalities designed to streamline the task of managing your finances, making them indispensable tools for anyone seeking to gain better control over their money.

Here’s a comparison table of the top checkbook apps for Android, highlighting their key features and benefits:

| Checkbook App | User-friendly Interface | Security Measures | Syncing Capabilities | Cost-effectiveness |

|—————–|————————-|————————|———————–|——————–|

| App A | Intuitive design | Advanced encryption | Cloud sync | In-app purchases |

| App B | Customizable dashboard | Biometric authentication | Multi-device sync | Free with ads |

| App C | Simplified navigation | Transaction alerts | Bank integration | Subscription-based |

| App D | Interactive visuals | Passcode protection | Manual import/export | One-time purchase |

User-friendly Interfaces and Features 💼

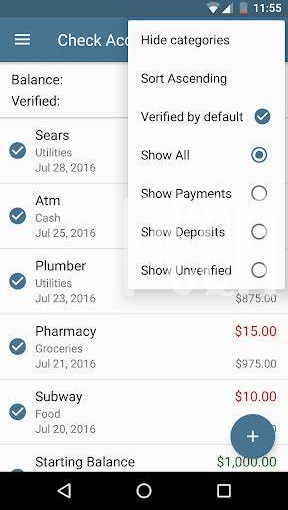

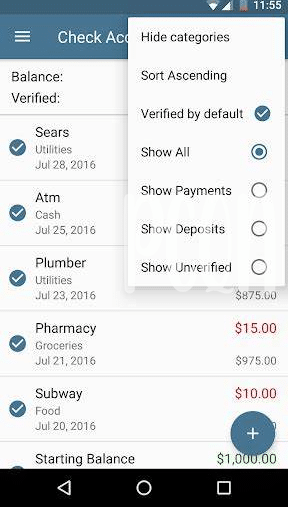

When it comes to user-friendly interfaces and features in checkbook apps, convenience is key. Whether it’s a simple layout, intuitive navigation, or customizable categories, these apps strive to make managing finances a seamless and enjoyable experience. The ability to quickly add, edit, and categorize transactions enhances user satisfaction and facilitates better financial organization. Additionally, interactive visuals such as graphs and charts provide users with a clear overview of their spending habits, enabling them to make more informed financial decisions. Providing a range of features that cater to different financial needs, from recurring transactions to bill reminders, ensures that users can personalize their experience and stay on top of their finances effortlessly.

The inclusion of innovative features like receipt scanning, automatic transaction categorization, and budget tracking further demonstrates the commitment of these apps to user convenience. The use of clean and modern design elements, alongside responsive customer support and regular updates, solidifies the user-friendly nature of these checkbook apps, making them valuable tools for Android users looking to manage their finances effectively. The combination of user-friendly interfaces and feature-rich functionalities helps users stay organized and in control of their finances, ultimately making their financial management experience more efficient and enjoyable.

Link to the best video player app for Android in 2024: What is the best video player app for Android in 2024

Security and Privacy Measures 🔒

When it comes to managing your finances, ensuring the security and privacy of your personal information is of utmost importance. With the increasing prevalence of digital transactions, it’s crucial to choose a checkbook app that prioritizes the protection of your data. Look for apps that offer encryption for your financial records and implement stringent security measures to safeguard your information from potential threats. Additionally, opt for platforms that provide secure login processes, multi-factor authentication, and the ability to set up passcodes or biometric locks to access the app. By selecting a checkbook app with robust security and privacy features, you can have peace of mind knowing that your financial data is well-protected.

Syncing Capabilities and Integration 🔄

When it comes to choosing the best checkbook app for Android, syncing capabilities and integration are essential features to consider. A top-notch app should seamlessly sync with your bank accounts, credit cards, and other financial platforms, ensuring that your financial data is always up-to-date and readily accessible. Integration with other financial management tools such as budgeting apps or investment platforms adds further convenience, allowing for a holistic view of your financial portfolio. The ability to sync and integrate with various financial sources ultimately streamlines the user experience, making financial management more efficient and effective.

For more insights on must-have apps for Android, check out our article on the best video player app for Android in 2024, offering an in-depth analysis of the top options available. With the rapid advancements in technology, staying informed about the latest app developments is crucial to optimizing your Android experience and enhancing your daily productivity.

Cost-effectiveness and Additional Services 💵

Cost-effectiveness is a crucial factor to consider when choosing a checkbook app for managing your finances. Beyond the basic functionality of tracking expenses and balancing your checkbook, many apps offer additional services such as bill payment integration, financial reports, and budgeting tools, which can provide added value for users. Some apps may offer these services at no additional cost, while others may require a subscription fee. Comparing the cost-effectiveness and additional services of each app can help users determine which one best meets their financial management needs in the most economical way. By carefully evaluating the range of features and services offered in relation to the cost, users can make an informed decision to maximize the benefits they receive from their chosen checkbook app.

| Cost-effectiveness and Additional Services |

|——————————————–|

| Bill payment integration |

| Financial reports |

| Budgeting tools |

| Subscription fees |

Expert Recommendations and Final Thoughts 🌟

When it comes to expert recommendations for the best checkbook apps available for Android, it is essential to consider the specific needs and preferences of the user. Each individual’s financial management style and priorities play a significant role in determining the most suitable app. For those looking for a comprehensive and intuitive checkbook app, it’s crucial to prioritize user-friendly interfaces and features that streamline the financial tracking process. Additionally, strong security and privacy measures are non-negotiable, ensuring that sensitive financial information remains protected. The syncing capabilities and seamless integration with other financial tools can greatly enhance the overall user experience, making it easier to manage and track expenses across different platforms. Cost-effectiveness and additional services also factor into the equation; a good checkbook app should offer value for money and potentially provide extra features that align with the user’s financial goals. Ultimately, the final choice depends on the unique requirements of the user, and it’s important to weigh all these factors to make an informed decision.