- 🧐 Assessing Your Financial Tracking Needs

- 💡 Exploring App Features and Capabilities

- 🎯 Setting a Budget for Your Bill Manager

- 🔒 Prioritizing Security and Privacy Measures

- 📱 User-friendly Design: Navigating with Ease

- 🔄 Syncing with Banks and Updating Automatically

Table of Contents

Toggle🧐 Assessing Your Financial Tracking Needs

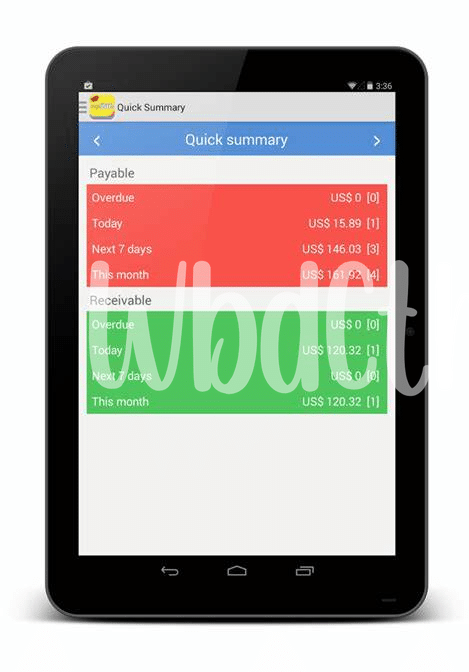

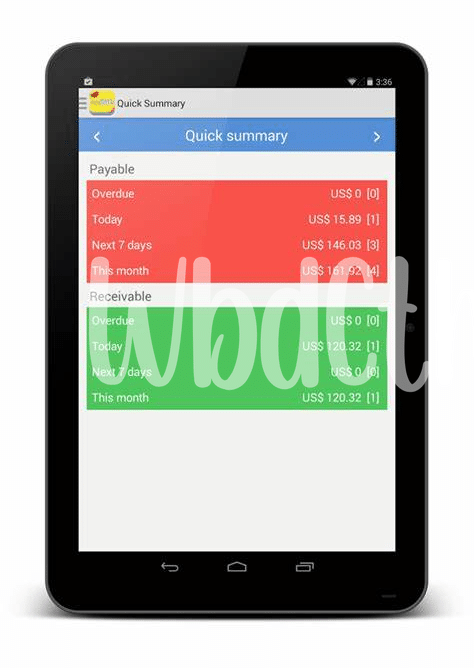

When looking into how to keep track of your bills, it’s key to start by understanding what you need from an app. Think of the bills you pay: electricity, water, phone, internet, and maybe even streaming services. Are they steady, like a calm river, or do they fluctuate like the tides? You want to capture this ebb and flow efficiently. It might help to jot down what you pay regularly versus what changes. Ask yourself if you need reminders for due dates or if you want an app that can show you a simple chart of where your money’s going each month. 🤔

Let’s not forget about the future. Are you planning big purchases or saving for vacations? A good bill management app can help you set aside funds for these goals without cluttering up your main budget. It’s all about finding a balance that works for you. Check out this comparison of potential needs to keep in mind:

| 🔎 Need | ✅ How an App Can Address It |

|---|---|

| Regular Bill Tracking | Automatic reminders and payment logs |

| Spending Analysis | Visual charts and customizable reports |

| Saving Goals | Separate tracking for long-term objectives |

| Income and Expenses | Balance overview and cash flow trends |

For those of you starting to navigate through your finances, an app offering a mix of these capabilities might be perfect. Consider whether a simple interface or a more detailed analysis suits you best. Your choice will lay a foundation to not just track bills, but also to take control of your financial future. 🚀

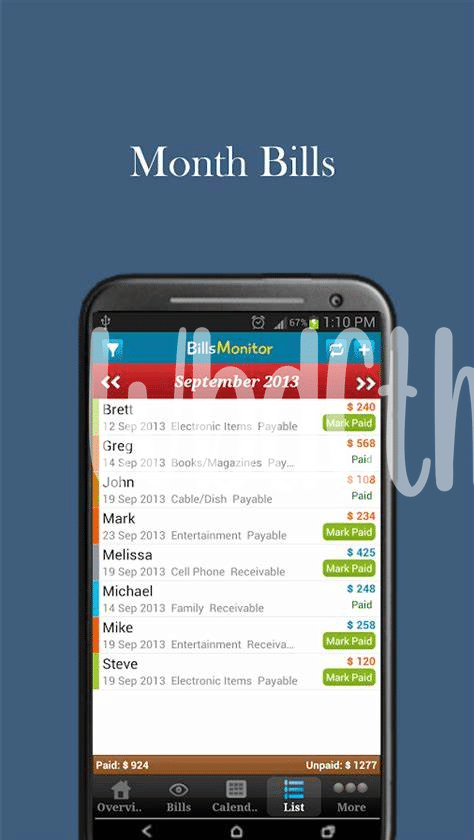

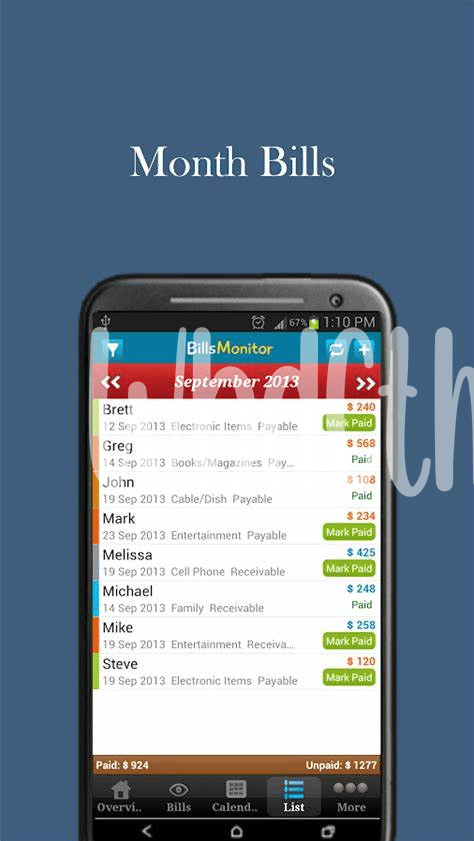

💡 Exploring App Features and Capabilities

When diving into the sea of bill management apps, think of yourself as a detective looking at all the cool gadgets. Each app has its own set of tools – some may automatically remind you when bills are due, while others might track your spending patterns over time, giving you a clearer picture of where your money’s going. Imagine an app that can show you colorful charts and graphs; it’s like a fitness tracker but for your finances, showing your financial health. Now, you might also find apps that offer advice, like a digital financial buddy suggesting ways to save money or avoid late fees. Plus, with the right app, you could link it to your accounts, so it keeps everything up-to-date like a diligent personal assistant. And remember, when you need to keep other documents in line with your finances, finding the best free scan & fax app for android 2024 top 5 apps updated can be just as crucial. So, as you’re evaluating these digital tools, think about which bells and whistles will make your life easier and help you to stay on top of your bills without turning budgeting into a full-time job. After all, who doesn’t want a smart assistant that makes managing money less of a chore?

🎯 Setting a Budget for Your Bill Manager

When it comes to managing bills, many of us might tense up thinking about costs – but fear not! 🌱 Finding a bill manager app shouldn’t stress your wallet; it’s about smart shopping. Imagine setting your sights on an app; it has all the bells and whistles but then comes the price tag, and it’s like a bucket of cold water. Here’s the scoop: you don’t necessarily need to splash out on the most expensive option. Before you dive into choices, think about how much you’re willing to spend on this digital helper. A little tip: sometimes, free versions can do the trick, especially if you’re juggling just a handful of bills. If you’re up against a mountain of receipts and invoices, then it might be wise to invest a few bucks into something a tad more robust. 💼

Keep your eyes peeled for apps that offer a good balance between cost and functionality – that’s your sweet spot! 🎯 And remember to read between the lines: some apps may look cheaper upfront but watch out for those sneaky in-app purchases or subscription fees that can add up. A solid plan would be to try out free trials – they’re like test driving a car, but for your finances. By giving these apps a spin without spending a dime, you’ll get a clear sense of what you’re actually getting for your hard-earned cash. So, set aside time to compare, take notes on what you truly need versus nice-to-haves, and settle on an app that doesn’t just keep your bills in check but also plays nice with your budget.

🔒 Prioritizing Security and Privacy Measures

In the world of bill management apps, where your financial details are as precious as treasure in a vault, the strength of the security offered can’t be over-emphasized. Imagine a world where your monetary movements are tracked with the precision of a hawk without your knowledge – it sounds like a spy movie, right? But this could be a reality if the chosen app doesn’t take security seriously. Good bill management software should lock down your data tighter than your most secret diary. It should boast features like robust encryption, which scrambles your data into a secret code that only you can understand, and multi-factor authentication, which is like having a secret handshake that only you and the app know.

Aside from a fortress-like defense, privacy is the quiet guardian ensuring that your financial data doesn’t become dinner table gossip. The right app should have clear policies stating how your information is used and assure you that it’s not shared with anyone not wearing the “need-to-know” badge. 🛡️ Also, because you wouldn’t want your bill management app to be as outdated as last year’s calendar, it’s crucial that it stays updated with the latest in digital security practices. In the midst of safeguarding your bills, don’t forget to enhance your productivity suite, too. For keeping your office mobile, you might be wondering what is the best free scan & fax app for android 2024 top 5 apps updated?. Finding a reliable scan and fax app complements your security-forward bill manager, ensuring all angles of your financial administration are covered with vigilance. 🚀 Your financial peace of mind depends on these security and privacy heroes standing guard 24/7.

📱 User-friendly Design: Navigating with Ease

There’s something quite satisfying about opening an app that feels like it was made just for you. Imagine a tool that greets you with clear buttons, simple menus, and all the important info right where you need it—sounds dreamy, right? Well, when picking out a bill management app, that’s the kind of user-friendly experience to look out for. 🌟 It’s like having a personal finance buddy in your pocket, one that doesn’t make you scratch your head in confusion. The key is finding an app that takes the guesswork out of managing your money, with a layout so intuitive, you barely need instructions. Think big, easy-to-read numbers and gentle nudges when it’s time to pay up, all designed to make life a bit easier.

But what really makes an app a breeze to use? Picture this: You’re having coffee, your phone pings, and just like that, you’ve checked your bills with a couple of taps. 💁♀️ That’s the marvel of a well-thought-out interface. To spot a winner, do a little detective work. Dive into those app reviews and hunt for words like “straightforward” and “no-brainer.” And remember, the best apps often let you take a test drive first. So, go ahead, try them out! Finding the one that clicks without making you think too hard means you’ve hit the user-friendliness jackpot. 👌

| Feature | Description |

|---|---|

| Intuitive Layout | Easily navigate through the app with clear labels and simple menus. |

| Clear Instructions | Get up and running fast without lengthy tutorials—everything feels natural. |

| Test Drive | Try the app before committing to see if it feels right for you. |

| Review Analysis | Look for consistent praise in user reviews about ease of use. |

| Notification System | Receive gentle reminders and updates without feeling overwhelmed. |

🔄 Syncing with Banks and Updating Automatically

Imagine waking up to a cup of coffee and a notification that all your bills and accounts are neatly organized and updated. That’s the magic of a good bill manager app that connects with your banks and financial institutions seamlessly. As you sip your brew, your app is already busy at work, behind the scenes, diligently fetching the latest transactions and bill details. 🌐🔄 It’s like having a personal finance assistant in your pocket, one that never takes a break. This feature means no manual entry of expenses, no missed bill payments, and no surprises when you check your account balances. It’s all about convenience and accuracy; your financial data is gathered and sorted without you lifting a finger. ✨ So, while you go about your day, the app ensures everything is up-to-date, giving you a real-time view of your finances. This synchronization also means you can spot any unusual activity quickly, keeping you one step ahead in managing your money like a pro. But remember, effortless doesn’t mean carefree; always keep an eye on what’s automated to ensure it matches your real-world spending and saving. With the right app, you can rest easy knowing your financial life is organized, current, and under control. Now that’s a smart move for staying on top of your finances! 🏦💼