- The Evolution of Android Pay in 2024 🌐

- Top Features of the Leading Wallet Apps 💳

- The Impact of Ai and Biometric Security 🤖

- The Rise of Decentralized Finance (defi) ⚖️

- Customer Experience and Personalization Trends 🛍️

- The Future of Contactless Payments and Wearables 💳

Table of Contents

ToggleThe Evolution of Android Pay in 2024 🌐

In 2024, Android Pay has undergone a significant transformation, adapting to the changing landscape of digital payments. The evolution has seen the integration of advanced technologies, enhanced security measures, and a focus on improving the overall user experience. With the emergence of new trends and the rapid evolution of financial technology, Android Pay has positioned itself as a leading player in the digital wallet space, catering to the needs of tech-savvy consumers in a fast-paced, interconnected world.

| Evolution of Android Pay in 2024 |

|———————————-|

| Advanced Technologies |

| Enhanced Security Measures |

| Improved User Experience |

| Catering to Tech-Savvy Consumers|

The evolution of Android Pay in 2024 represents a pivotal moment in the history of digital payments, marking a shift towards seamless, secure, and personalized transactions that cater to the dynamic needs of modern consumers.

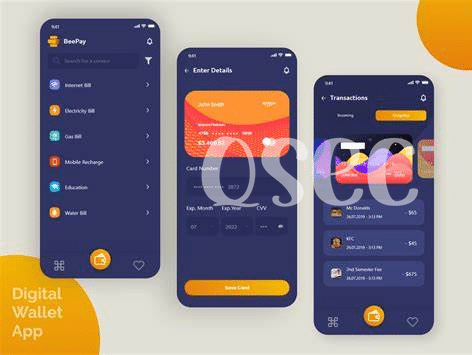

Top Features of the Leading Wallet Apps 💳

The leading wallet apps in 2024 are equipped with an array of cutting-edge features designed to streamline the user experience, provide enhanced security, and offer increased convenience. These apps go beyond simple payment processing, incorporating functionalities such as budget tracking, expense categorization, and personalized money management insights. Additionally, integration with loyalty programs and rewards schemes has become a standard offering, allowing users to effortlessly accumulate and redeem benefits directly from their chosen wallet app. The user interface and overall design have also undergone significant improvements, focusing on intuitive navigation, customizable dashboards, and seamless integration with other financial tools and services. Furthermore, the integration of artificial intelligence and biometric security measures has led to advanced levels of protection, ensuring that transactions are not only convenient but also highly secure. As the realm of fintech continues to evolve, these leading wallet apps represent the forefront of innovation, setting new standards for the future of digital financial management.

The Impact of Ai and Biometric Security 🤖

In 2024, the integration of AI and biometric security has revolutionized the Android Pay landscape, ensuring enhanced user authentication and transaction security. With AI-powered algorithms, wallet apps can analyze user behavior, identify potential fraudulent activities, and provide personalized security recommendations. Biometric authentication, including fingerprint and facial recognition, has become a standard feature, offering a seamless and secure payment experience. These advancements have significantly reduced the risk of unauthorized access and fraudulent transactions, assuring users of a heightened level of security and peace of mind when using Android Pay.

The utilization of AI and biometric security measures has not only enhanced the security of Android Pay but has also facilitated a more convenient and personalized user experience. By leveraging biometric data, wallet apps can streamline the authentication process, eliminating the need for cumbersome passwords or PINs. Additionally, AI algorithms can analyze spending patterns and preferences to offer tailored recommendations and promotions, enhancing customer satisfaction and loyalty. As security concerns continue to evolve, the integration of AI and biometric technology in Android Pay has undoubtedly set a new standard for seamless, secure, and personalized payment solutions.

The Rise of Decentralized Finance (defi) ⚖️

The rise of decentralized finance (defi) in the Android Pay evolution is reshaping the landscape of digital transactions. In 2024, we are witnessing a notable shift towards defi, marking a significant departure from the traditional centralized finance systems. Decentralized finance enables users to access financial services such as borrowing, lending, and trading directly through blockchain technology, eliminating the need for intermediaries like banks. This trend stands as a testament to the growing trust in blockchain technology and the desire for more accessible and inclusive financial solutions. As defi continues to gain traction, it is poised to revolutionize the way we perceive and engage with financial services, paving the way for a more democratized and transparent financial ecosystem.

To stay updated with the latest advancements in mobile technology, especially for content creators using Android devices, it’s essential to explore the best teleprompter app for Android in 2024. Check out this comprehensive breakdown of the best Android teleprompter apps for content creators in 2024 to enhance your video production workflow. What is the best teleprompter app for android in 2024?

Customer Experience and Personalization Trends 🛍️

In 2024, the landscape of customer experience and personalization trends in mobile wallet apps has significantly evolved 🛍️. With the advancement of technology, companies are leveraging customer data to deliver highly personalized experiences, catering to individual preferences and behaviors. The integration of artificial intelligence has enabled real-time personalization, providing users with tailored recommendations and offers based on their transaction history and shopping patterns. Additionally, the implementation of biometric security measures not only ensures a seamless and secure payment process but also enhances the overall user experience. These advancements have redefined the way customers interact with wallet apps, ultimately setting new standards for convenience and personalized service.

| Future of Customer Experience and Personalization Trends |

| :——————————————————: |

| In 2024, the landscape of customer experience and personalization trends in mobile wallet apps has significantly evolved 🛍️. With the advancement of technology, companies are leveraging customer data to deliver highly personalized experiences, catering to individual preferences and behaviors. The integration of artificial intelligence has enabled real-time personalization, providing users with tailored recommendations and offers based on their transaction history and shopping patterns. Additionally, the implementation of biometric security measures not only ensures a seamless and secure payment process but also enhances the overall user experience. These advancements have redefined the way customers interact with wallet apps, ultimately setting new standards for convenience and personalized service. |

The Future of Contactless Payments and Wearables 💳

The evolution of contactless payments and wearables in 2024 is set to revolutionize the way consumers engage in transactions. With the integration of advanced technologies such as NFC and RFID, contactless payments are expected to become even more seamless and secure. Wearables, including smartwatches and other IoT devices, will play a significant role in enabling convenient and efficient payment experiences for users on the go. As the demand for speedy and secure transactions continues to grow, the future of contactless payments and wearables holds great promise for enhancing the overall payment ecosystem.