- Cash Flow Clarity: Seeing Beyond the Spreadsheets 🌟

- Effortless Expense Entries: Saving Time and Stress 💡

- Smart Spending with Budget Insights and Alerts 🎯

- Going Paperless: Environmentally-friendly Financial Management 🌱

- Harnessing Analytics for Smarter Business Decisions 📊

- Personalized Expense Management with Ai Assistance 🤖

Table of Contents

ToggleCash Flow Clarity: Seeing Beyond the Spreadsheets 🌟

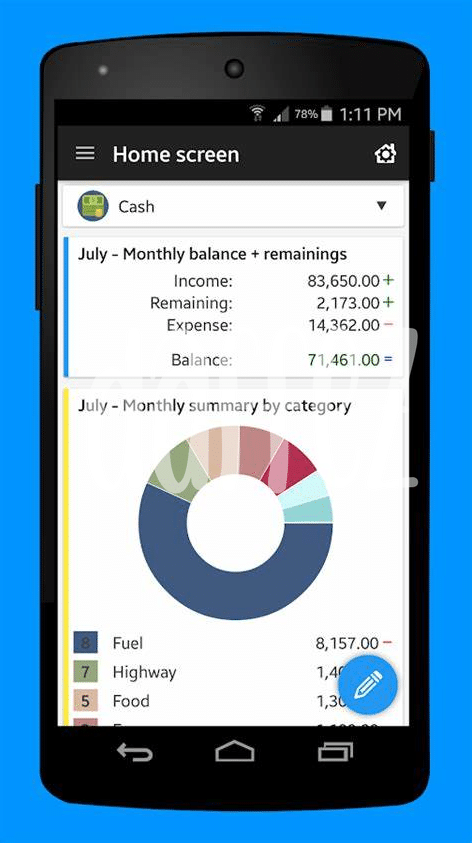

Imagine you’re on a sunny beach, watching the waves roll in, with every ebb and flow matched by the rhythm of your business’s cash. Now, there’s no need to squint at rows and columns on spreadsheets to understand where your money is going. Expense apps are like high-powered binoculars, giving you a beachside view of your financial landscape. 🌟 They make it easy to spot where the cash is coming in from and where it’s riding the wave out. This isn’t just about seeing numbers; it’s about spotting trends and understanding the health of your business without getting pulled under by data overload. You don’t have to be a Bitcoin Maximalist to know that clarity is king in controlling your finances.

Harnessing the power of these nifty tools transforms the murky waters of financial tracking into a clear lagoon. 🐠 You can dive deep into your business’s cash flow with ease, far beyond the traditional spreadsheet. It’s about gaining peace of mind, not being a Bagholder of stress. Instead of cryptic data, get crystal-clear insights that help you feel like you’re surfing the crest of your financial wave. Whether you’re looking to BTD or just keep a steady keel, these apps have got your back. With everything in one place, you might just say goodbye to FOMO and hello to a new confidence in your financial journey. 🚀

| Feature | Benefit |

|---|---|

| Trend Spotting | Identify financial patterns at a glance without deep analysis. |

| Real-Time Updates | Stay informed about cash flow changes as they happen. |

| Consolidated Data | Access all financial information in one streamlined view. |

Effortless Expense Entries: Saving Time and Stress 💡

Imagine trying to manage your finances, and instead of feeling like a bitcoin maximalist confidently watching the market, you feel like a bagholder, uncertain where your money is going. Now, forget those days because with the latest app technology, you can turn those moments of doubt into a triumphant “LFG!” Get ready to wave goodbye to the olden days of poring over crumpled receipts and entering data into endless columns. With a few taps, you can feed your finance app with purchases, bills, and incomes, and watch as it sorts and organizes everything for you. This isn’t just about saving a few minutes—it’s about reclaiming hours, reducing errors, and trimming down your to-dos to almost nothing.

Meanwhile, have you ever found yourself drowning in a sea of paper receipts, grappling with the stress it brings? Make that a problem of the past. These apps don’t just play nice with numbers; they’re a boon for the environment. By switching to a paperless trail, you’re participating in eco-friendly financial management. And if your phone needs a bit of tidying too, there’s an easy fix. Imagine a finance app that’s like the best cleaner app for android, for your expenses — it helps you clean up financial clutter and keep your economic health in check. The journey from tracking every dime to a thriving financial state has never been more straightforward, or more stress-free.

Smart Spending with Budget Insights and Alerts 🎯

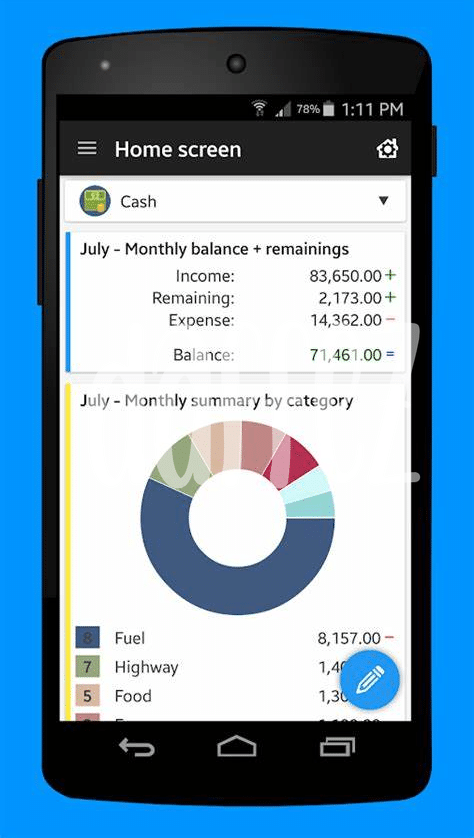

Imagine being able to support your spending decisions with more than just a gut feeling! Expense apps now offer personalized budget insights, turning the once-tedious task of managing money into a streamlined experience. 🎈 By analyzing your spending patterns, these apps shine a light on where your cash is flying, gently nudging you if your shopping spree is going into overdrive. No need to suffer from FOMO as your friends flaunt their latest gadgets; with real-time alerts, you’re empowered to buy the dip on your expenses, not your savings.

Gone are the days of being a bagholder for unnecessary expenses, holding onto services that drain your wallet more than they contribute to your happiness. Intelligent alerts help to curb impulsive buys, making sure you’re a savvy shopper without the hassle. 🛍️💼 The best part? You can leave the cryptosis to the crypto traders! With these smart expense tools, you can ensure that every dollar you spend is a step towards financial wellbeing, not a slide towards being rekt by your bills.

Going Paperless: Environmentally-friendly Financial Management 🌱

Imagine your office with more space and less clutter – that’s the picture perfect scenario you get when you embrace a modern solution to handle your monetary matters. With the magic of apps, you’re not just saving trees by reducing the need for paper; you’re stepping into a world where your financial data is organized at your fingertips – no more digging through drawers for that one lost receipt. This transformation isn’t just about being green, though that’s a huge plus. It’s also about lightening the load on your shoulders, enabling you to manage finances fluidly without sifting through piles of paper that can feel overwhelmingly chaotic. Think of it as having diamond hands when it comes to resisting the old ways of printing and filing – a true paradigm shift in the eco-system of expenditure management.

Not only does going digital give you real-time access to your financial data, ensuring you’re not left FOMO-ing over last minute expense reports, but it also integrates seamlessly with other tools and services. For instance, you might find the best cleaner app for android, helping you keep your device just as tidy as your accounts. By joining forces with these progressive apps, you’re not just tracking your spending; you’re turning what was once a chore into an effortless, stress-free part of your life. In this age where things move fast, it’s crucial not only to keep up but to stay ahead, making smart choices that benefit your wallet and the world.

Harnessing Analytics for Smarter Business Decisions 📊

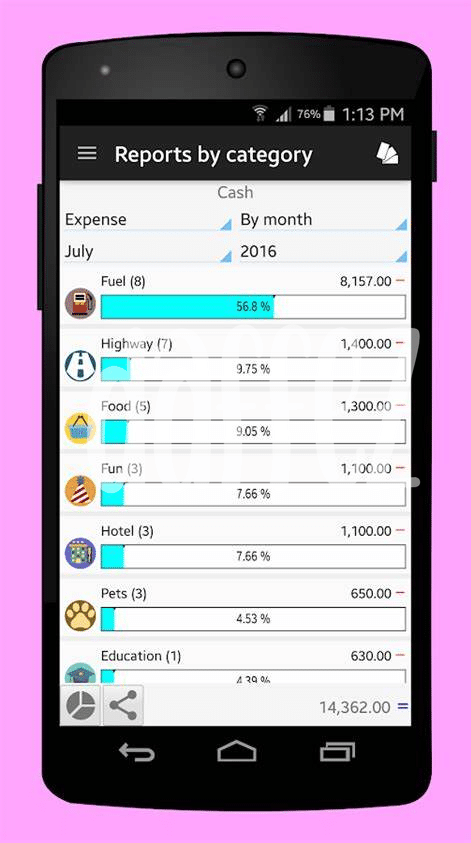

Imagine peering into a crystal ball and seeing the patterns of your business unfold. With modern expense apps, this is not just make-believe; it’s analytics at your fingertips! 📊 These tools transform numbers into narratives, helping business owners make wiser choices. No longer do you have to be a bagholder, grasping at strategies that no longer serve your bottom line. Instead, smart software sweeps in, turning the tides of data into actionable insights. By analyzing past spending, these apps can predict future trends, safeguarding you against the proverbial storm.

| Feature | Description |

|---|---|

| Expense Trends | Track where your money is going most frequently, and identify any unusual patterns. |

| Profit Analytics | See which products or services are your biggest money-makers and allocate resources accordingly. |

| Budget Forecasting | Use historical data to predict future expenses and income, helping you to plan better. |

It’s common in the business world to experience FOMO when making financial decisions. You might worry that you’re not investing enough, growing fast enough, or optimizing as well as the competition. However, these apps act like a financial compass, guiding you towards judicious investments and spending with confidence. Imagine having diamond hands when it comes to your business finances—holding firm in your decisions, backed by robust data. That’s the peace of mind that comes with leveraging advanced analytics in your expense management tools. 🎯🤖

Personalized Expense Management with Ai Assistance 🤖

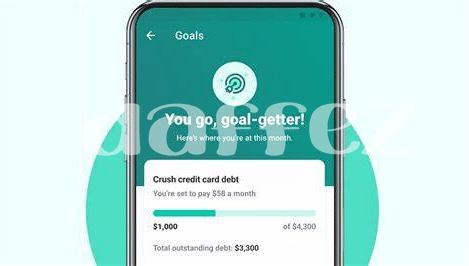

Imagine your expense management being as sly and smart as a fox, with a virtual assistant that not only tracks your dollars and cents but also gets to know your spending habits better than you know them yourself. This tech-savvy helper takes the tedium out of managing receipts and expenses. Through artificial intelligence, it learns from your transactions, predicting future spends and offering advice so you don’t have to worry about becoming a bagholder of unnecessary costs. 🦾💼🔍

These intelligent systems are not just about keeping you out of the red; they’re proactive financial companions. They work tirelessly in the background, ensuring you’re not caught by surprise when a big expense is on the horizon. By alerting you to FOMO-induced splurges, they encourage smarter spending habits, and, much like having diamond hands in the world of investing, they help ensure that your financial grip remains solid even when the market takes a dip. They’re not just tools; they become partners in your financial wellbeing, shining a light on areas for improvement and celebrating with you when your balances are mooning. 🌕✨💡