- Unveiling the Top Android Wallet Apps of 2024 🌟

- Securing Your Savings with Robust Safety Features 🔒

- Navigating the User-friendly Interfaces with Ease 👆

- Integrating Finances: Multiple Accounts, One App 🔗

- Taking Control with Budgeting and Analytics Tools 📊

- Enjoying Seamless Transactions with Tap-to-pay 💳

Table of Contents

ToggleUnveiling the Top Android Wallet Apps of 2024 🌟

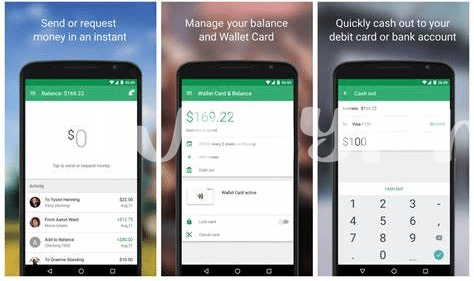

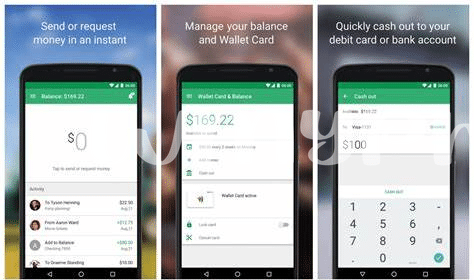

If you’ve ever felt like managing your money is a jumble of numbers and confusing apps, you’re not alone. But it’s 2024, and the future of finance is right at your fingertips! Let’s dive into the cream of the crop when it comes to Android wallet apps this year. Think of them as your financial fairy godparents, transforming the way you interact with money. They’re not just safe—they’re like a vault for your pocket! With cutting-edge technology, these wallet wonders safeguard your hard-earned cash with features that are like having a personal finance guard dog.

The best part? They play nice with your phones and screens of all sizes. Imagine running your finances as smoothly as your favorite chat app. It’s all “tap tap” and, like magic, you know where you stand with your spending without needing a degree in rocket science. It’s smart money management for everyone – simple, quick, and dare we say…a little fun? These wallet apps let you bring together all your bank accounts and cards in one cozy digital home. You can monitor every dime and dollar with a bird’s-eye view that makes your financial health clear and concise.

| App Name | Safety Features | User Interface | Finance Integration |

|---|---|---|---|

| MoneyGuardian | Fingerprint & Face Recognition | Color-Coded Categories | All-in-One Dashboard |

| CashCastle | End-to-End Encryption | Drag & Drop Budgeting | Multi-Account Sync |

| DigitalWallet+ | Real-Time Fraud Monitoring | Voice-Activated Commands | Investment & Savings Tracker |

So whether you’re saving up for that dream vacation or just trying to keep a closer eye on your shopping sprees, these top Android wallet apps are your financial knights in shining armor. Say goodbye to the days of overwhelming spreadsheets and say hello to a new chapter of financial freedom and empowerment. Let’s get excited about managing money—because it’s never been this easy, or this secure. 📈🔐📱

Securing Your Savings with Robust Safety Features 🔒

Making sure your money is as safe as can be is like making sure your front door is locked — it’s a must. The Android wallet apps coming out in 2024 are like having the best locks money can buy. They come with features that are like having a guard dog for your finances; things like fingerprint and facial recognition that make sure you’re the only one getting in. Plus, with top-notch encryption — think of it as an unbreakable safe where your money’s sleeping tight. Some apps send you a message whenever anything happens with your account, like a digital watchdog who’s always on the lookout. And don’t worry if all this talk of security starts to sound complex — these apps are designed to be simple. So, even if tech isn’t your thing, you can still keep your money safe without a headache. Just like the camera on an updated phone captures a moment perfectly, these apps capture and protect every penny. So, you can sleep a little easier knowing it’s all taken care of. Want to snap the best shot of your finances? Keep an eye on what can complement your safety with the best camera app for android 2024 top 5 apps updated phone.

Navigating the User-friendly Interfaces with Ease 👆

Think about the moment you download a new app onto your shiny Android phone. You’re excited, curious, but also a little worried. “Will I figure this out?” you might ask yourself. Well, with the latest wallet apps of 2024, that worry is a thing of the past. Imagine tapping open an app and it feels like it’s almost reading your mind. The icons are where you expect them to be; the colors are easy on the eyes; and every swipe, tap, and pinch feels as natural as flipping the pages of your favorite magazine. Picture yourself effortlessly peeking at your accounts, gliding through menus, and setting everything up without the need to search for a help guide. It’s like your favorite comfy chair – it just feels right.

The best part? You don’t need to be a tech whiz to understand it. These apps are made for everyone. Your grandma, your teenager, even your neighbor who still has that ancient flip phone – they can all jump in without skipping a beat. All the cool shortcuts and features are there to discover at your own pace, no rush or pressure. And when you do need a little help, the hints and tips are as friendly and simple as asking your buddy where the best place is to grab a pizza. With such a smooth ride on the digital finance highway, you’re not just keeping up; you’re cruising ahead, empowered to handle your cash with a smile. 😊💡✨

Integrating Finances: Multiple Accounts, One App 🔗

Imagine the ease of having all of your financial accounts safely nested in the palm of your hand. This isn’t a dream; the 2024 Android wallet apps transform this into a crisp reality. With everything in one place, tracking your checking accounts, savings, and even that fun money you set aside for a rainy day becomes a breeze. 🔄 The beauty lies in the clever design of these apps, knitting together different financial threads into a single tapestry. Imagine being able to glance at your phone and see every account balance, transaction, and upcoming bill without swapping between a dozen different apps.

While you’re reveling in the unity of your financial life, it’s a perfect moment to explore other realms where your Android phone can shine. Whether it’s capturing life’s moments or snapping a budget-friendly homemade masterpiece, finding what is the best camera app for android 2024 top 5 apps updated phone will ensure your visual game is as on point as your fiscal savvy. Peel back the layers of your financial onion through the lens of convenience and control these apps offer. 📸 As you monitor your wealth’s health with pinpoint accuracy, you’ll marvel at the finesse with which these tools not only gather but also interpret your data, providing a splendor of graphs and forecasts. It’s like having a financial advisor in your pocket, ready to guide you towards wiser spending and saving habits. 🧭 Embrace the holistic approach of modern financial management, and make the most out of every swipe, tap, and touch on your Android device.

Taking Control with Budgeting and Analytics Tools 📊

Imagine having a smart friend in your pocket that helps you make sense of your money – where it goes, how much you save, and what you’re spending too much on. That’s what the latest Android wallet apps are offering in 2024. These apps come with tools that act like a magnifying glass over your finances, showing you the fine print of your spending habits in vibrant charts and easy-to-understand visuals. 📉🤓 Whether you’re saving up for a dream vacation or just trying to keep your daily coffee habit in check, these tools lay it all out for you.

How much did you spend on eating out last month? Are you on track with your savings goals for that new bike? With a few taps, the app breaks it down for you with nifty diagrams and progress bars that change color from red to green as you get closer to your goals. ✅ The beauty lies in the simplicity; no need for a finance degree here. Plus, they learn from you – the more you use them, the smarter they become in helping you find ways to save without having to cut back on the fun stuff.

What’s even cooler is how these apps can spot trends in your spending. Maybe you’re spending more on gas every Thursday or there’s a monthly subscription you forgot about. By shedding light on these patterns, you can take action, tweaking your habits in a way that feels more like a game than a chore. And if the numbers start to look as swirly as your morning latte, friendly tips pop up to guide you back on track.

Here’s a quick look at what you might find in your app:

| Feature | Description | Benefit |

|---|---|---|

| Expense Categorization | Organizes expenses into categories such as food, utilities, and entertainment. | Easier to identify spending habits and cut costs in specific areas. |

| Savings Goals | Set and track progress towards specific financial goals. | Stay motivated and make saving money more rewarding. |

| Trend Analysis | Analyze spending over time to spot recurring patterns. | Adjust your budget based on real data and improve financial health. |

Ready to dive in and see your spending in a whole new light? Open up one of these wallet apps and start turning those bewildering bank statements into a colorful, easy-to-follow map to financial health. It’s like having a financial advisor in your corner, cheering you on every step of the way. 💪🎉

Enjoying Seamless Transactions with Tap-to-pay 💳

Imagine you’re out grabbing coffee or picking up a few things from the store. In 2024, there’s no need to fiddle with cash or cards. With the newest Android wallet apps, all it takes is a simple tap of your phone, and voilà, payment made! It’s like magic, but better because it’s real and it’s incredibly convenient. Your phone is now a powerful wallet, holding your payment information securely under lock and key 🔒, metaphorically speaking. As you tap your device to the payment terminal, the transaction is completed in a blink. No more digging through a cluttered wallet, no more swiping or inserting cards. This contactless payment feature is a game-changer for quick, hassle-free purchases.

The beauty of these apps lies not just in their tap-to-pay function but also in how they keep you informed 📊. After each tap to pay, you get instant updates, so you can track your spending without needing to punch numbers into a calculator. And, these apps don’t play favorites; they work with a wide array of banks and cards. So, this isn’t just about a new way to pay — it’s about simplifying your finances, keeping them all neatly tucked away in your phone, a device that’s already an integral part of daily life. With each tap, you’re not just paying for what you need or love; you’re stepping into the future of financial convenience, a future where life flows just a little more smoothly with every transaction 💳.