- Unveiling the Contenders: Top Wallet Apps 🏆

- Security First: Safeguarding Your Money 💼

- The Budgeting Brilliance: Features Face-off ✨

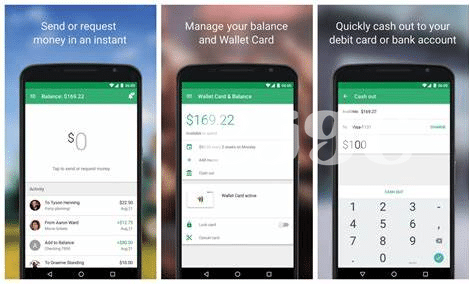

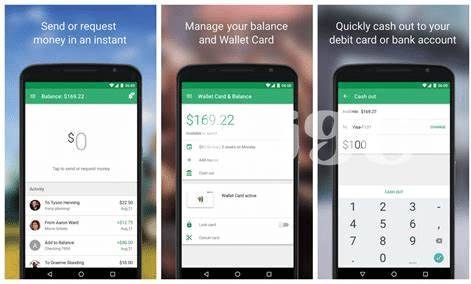

- User-friendly Factor: Navigating with Ease 🤳

- Offline Access: Managing Money on the Go 🌐

- The Cost of Convenience: Pricing Breakdown 💲

Table of Contents

ToggleUnveiling the Contenders: Top Wallet Apps 🏆

Imagine you’ve just hit the jackpot: a neat sum of money you didn’t expect to have. Excitement bubbles up as you face the alluring prospect of splurging on all you’ve dreamed of. But hold up! Before you join the ‘spend it all’ club, let’s divert that energy into smartly managing your newfound fortune. 🚀 Witness the heroes in the tale of financial savvy – the best Android wallet apps of 2024 are stepping into the spotlight. These digital guardians are more than just apps; they’re your personal finance gurus, constantly guarding every penny like diamonds in a vault, ensuring not a single cent slips through unnoticed. 💎

| Rank | App Name | Unique Feature |

|——|——————|———————————————-|

| 1 | WalletGenius+ | AI-driven budgeting insights |

| 2 | CashGuard Secure | Military-grade encryption |

| 3 | Savings Sentinel | Customizable savings targets |

| 4 | ExpendiTrack | Real-time expense tracking |

| 5 | BudgetBlast Pro | Fun rewards for saving milestones |

These apps, brimming with features, promise more than just a place to keep an eye on your spendings. They’re the toolbox for the modern-day user who might be tempted to ape into investment opportunities without second thoughts. The best part? They’re designed for everyone – whether you’re a financial guru or just starting to navigate the seas of personal finance, these apps ensure you won’t be a bagholder of bad budget decisions. And when the market does its thing, and everyone around shouts “BTD,” you’ll be calmly appraising, armed with your trusty app, ready to make a move that’s both wise and timely. Feels reassuring, right? These contenders have you covered from sophisticated financial plans to reminders for coffee cuts, and as you keep track of your dosh, you’ll be saving up not just money, but also peace of mind. 🌟 Remember, though, while embracing these digital sidekicks, to keep an eye on the basics – always check the app permissions and ensure their promisses aren’t just vaporware. That way, your digital financial journey will be as secure as it is empowering. Recieve updates, learn from them, and soon, you’ll be managing your wealth like a true maven, all from the palm of your hand. 📲

Security First: Safeguarding Your Money 💼

When it comes to keeping your cash secure on your phone, think of your wallet app as a trusty sidekick. These apps pack a punch with top-tier encryption and built-in security features to ward off any digital pickpockets with designs on your dough. They’ve got to stand strong against cyber threats, so you won’t end up like a bagholder clutching onto empty promises. With an Android wallet app, it’s all about peace of mind, knowing your transactions are wrapped in a virtual security blanket.

Now, I know dealing with money on your mobile might feel a bit like walking a tightrope, especially if you’ve heard tales of cryptosis and cryptojacking. But, fear not! These apps often come with multi-factor authentication options and frequent security updates to keep the bad guys at bay. Remember to DYOR to pick the app that’s right for you, so you won’t be the one getting rekt because of a weak security feature. And, just like the best tunes need to seamlessly download to your playlist, your finances need that smooth, safe pocket to ride in. Speaking of tunes, if managing your budget gets your head nodding to a beat, you might want to check out which android 2024 app is best for downloading music. 🎶📱🔒

The Budgeting Brilliance: Features Face-off ✨

When it comes to managing your finances, the right app can feel like a best friend that knows just what you need. This year’s lineup of Android wallet apps brings a dazzling array of features to help you keep track of every dime and dollar. Imagine an app that not only tracks your expenses but also gives you insights into where your money goes—without needing a finance degree to use it. 🌟 Security is a given, but where these apps truly shine is in their budgeting tools that help you plan for the future while staying grounded in the present.

You might find an app that offers clever ways to “ape” into saving, turning it into a game where you’re not just saving money; you’re scoring points against your past spending habits. And forget about becoming a “bagholder” of unwanted subscriptions; these apps can sniff out recurring charges and help you decide if they’re truly worth it. 👀 Some even come with widgets and alerts, so you feel like you have a finance coach right in your pocket, cheering you on with a “LFG” as you work towards your saving goals. Plus, should you ever encounter the urge to splurge, these apps provide visual cues to help strengthen your “diamond hands”—encouraging you not to sell out your financial future for a temporary thrill. 🙌

Although it’s a complex world of finances out there, these wallet apps are your partners in the journey, making the budgeting experience not just palatable but enjoyable. You won’t need to worry about getting rekt by unexpected expenses, as your budget is now in the palm of your hand, making every decision an informed one. And if you’re worried about getting the most bang for your buck, you’ll be pleased to know that the best things in life—and in apps—can often come free or at a minimal cost. This isn’t about restricting your lifestyle; it’s about enhancing it through smart, savvy steps that make cents add up to dollars that secure your dreams. 🚀

Remember, while apps are powerful, the ultimate control still lies within you. So, here’s to taking the reigns of your financial future in 2024, with a pinch of tech magic and a heap of your own determination!

User-friendly Factor: Navigating with Ease 🤳

When seeking out the perfect Android wallet app, stepping through a digital door should feel like a breeze rather than a puzzle. Envision an app that greets you with a smooth flow, laying out all your financial tools neatly. Swipe through your spending stats, an effortless tap to record an expense, all so intuitive that even your grandma could become a budgeting boss. For those who’ve felt rekt by clunky apps in the past, this will be like finding a calm oasis in the desert of digital finance.

Now, imagine you’re jamming to your favorite tunes and an unexpected shopping opportunity pops up. You’d want to switch from rocker to shopper without skipping a beat. That’s where our top picks excel, marrying simplicity with utility. For music lovers out there, there’s an equally painless experience waiting when you choose which android 2024 app is best for downloading music, ensuring you hit the right notes, both financially and melodically. So here’s to reclaiming time and tossing out teh stress – after all, we all deserve to navigate our budget with the elegance of a moonwalk.

Offline Access: Managing Money on the Go 🌐

Imagine being on a bumpy bus ride or sitting at a cozy mountain retreat, far from the best Wi-Fi or any city’s hustle. You pull out your smartphone, yearning to get a grip on your finances. With the right Android wallet app, you can do just that – even without an internet connection. 🌲🚌

These smart apps empower you with the magic wand to manage your money, ensuring not a single penny slips unnoticed. From checking your balance to categorizing your latest expenses, these tools keep you in command. Think of it as having your very own financial assistant, tucked right in your pocket, always ready to spring into action. 🧙♂️💰

But it’s not all perfect – sometimes, navigating these apps can feel like youre trying to decode a cryptic treasure map. However, the best ones are designed for normie users, not just the crypto-savvy. They take away teh fear of missing out on the latest market dip because you were off-grid and maintain a barricade against potential wallet invaders, just like a loyal watch-dog for your digital gold. So, grab your digital ledger and go forth into the world, rest assured that your assets are one quick tap away – no internet required. 🚀📲

| App Name | Available for Offline? | Data Sync When Online |

|---|---|---|

| Money Saver | Yes | Automatic |

| ExpendiTrack | Yes | Manual |

| Budget Buddy | Yes | Automatic |

The Cost of Convenience: Pricing Breakdown 💲

When it comes to keeping your digital money safe and sound, the apps that promise to help don’t always come free of charge – and sometimes, that’s where the savvy spender needs to squint at the fine print. Some of these Android wallet apps tempt you with no upfront costs, but be wary, for that might just be a honeymoon phase before subscription fees kick in. 💸 It’s a delicate balance, like deciding whether to HODL onto your assets or react to FUD, as each app can vary widely in what they ask from your wallet.

Peek under the hood of each app and you’ll often find a menu of micropayments for extra features. Need to manage multiple accounts or want to avert prying eyes with enhanced security? Be prepared to part with a few bucks. And let’s be honest, no one wants to end up a bagholder of unused premium services. Just remember, while free trials feel like a buffet of options, once they end, you might be the one getting served. And sure, an app might promise to take you to the moon 🚀, remember, there’s always a rocket fuel cost – so check if the price is right before you committ.