- Dive into the Basics of Cash App 🌊

- Why Verification Matters for Cash App Users 🔐

- Step-by-step Guide to the Verification Process 🛠️

- Troubleshooting Common Verification Hiccups 🚧

- Unlocking Higher Limits and Features 🔓

- Protecting Your Account Post-verification 🛡️

Table of Contents

ToggleDive into the Basics of Cash App 🌊

Cash App sweeps onto the financial scene like a breath of fresh air, an intuitive platform that aims to simplify peer-to-peer transactions and personal finance 💸. At its core, it’s an app that allows users to send and recieve money with ease, a digital wallet that caters to the modern need for swift and secure transactions. Its rising popularity is a testament to its user-friendliness and flexibility, offering a canvas on which both novices and seasoned users can paint their financial operations.

Embarking on the journey with Cash App is akin to setting sail on digital seas, where navigating the waves of financial tech is made a breeze 🌬️. However, despite its straightforward interface, it’s neccessary to wade through the initial setup before fully harnessing its powers. This includes linking bank accounts, setting up personal information, and, yes, going through the all-important verification process. Cash App’s verification acts as the gateway to a fully-fledged financial experience, a ritual that enhances both security and functionality.

| Feature | Unverified users | Verified users |

|---|---|---|

| Send Money Limit | $250/week | $2,500/week |

| Receive Money Limit | $1,000/month | Unlimited |

| Bitcoin Transactions | Unavailable | Available |

| Direct Deposits | Unavailable | Available |

Why Verification Matters for Cash App Users 🔐

Embarking on a digital finance journey with Cash App brings with it the key ingredient of trust 🌐. Understanding that verification is more than just a formality, it safeguards your account against potential fraud and ensures you’re the legitimate owner of the funds in transit. Imagine the scenario where anyone could impersonate you and wreak havoc with your hard-earned money – that’s a stark reality that verification processes seek to eliminate. Through this identity confirmation, Cash App fortifies your financial data, giving you the peace of mind to transact securely.

The process also paves the way for a more holistic Cash App experience 🚀. Once your identity has been verified, you’re entrusted with higher transactional freedoms – be it sending larger amounts to peers or investing in your favorite cryptocurrency. This elevated level of access is contingent upon the successful completion of Cash App’s security checks, establishing a necessary foundation for any future financial movements within the app’s ecosystem. It’s all about building a robust financial profile that can stand the test of digital threats while unlocking the full spectrum of features that enhace your financial agility.

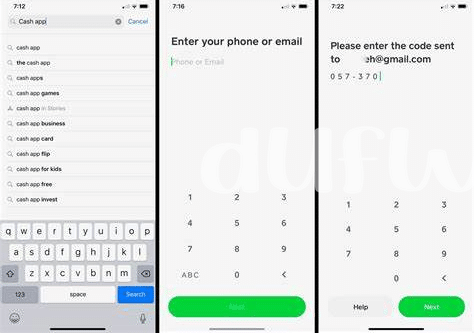

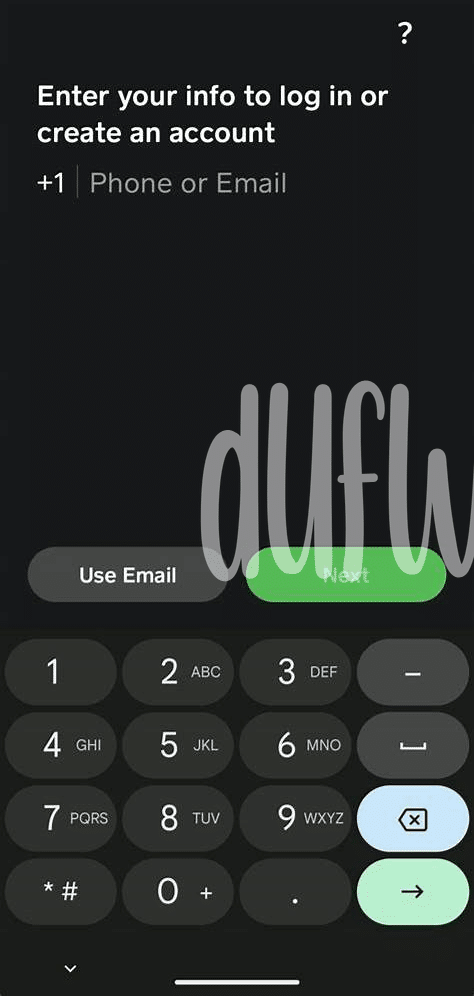

Step-by-step Guide to the Verification Process 🛠️

Embarking on the digital voyage to validate your Cash App account is simpler than you may think. Initially, after logging in, navigate to the ‘Funds’ section and tap on the ‘Add Card’ option to link your bank account or card. Here, you’ll input your personal details, including your full legal name, date of birth, and the last four digits of your SSN. 🤳 If a picture ID is required, you’ll need to capture a clear, glare-free photo of your driver’s license or state ID. While the process is typically smooth sailing, remember that all details must match your official documents flawlessly to avoid any hiccups.

Following submission, the verification engine kicks into gear and you begin a brief waiting game for approval – which can take up to 48 hours. Should you face a head-scratching moment where your application seems to have vanished into the digital ether, a quick visit to the ‘Support’ section can illuminate the situation. ⌛ Be patient, as multiple verification attempts can sometimes lead to temporary account freezes, but rest assured that these precautionary measures are there to safegaurd your financial flotilla. Keep an eye on your linked email for that all-important confirmation to arrive, signaling that you’ve successfully anchored your account in verified waters.

Troubleshooting Common Verification Hiccups 🚧

While venturing through the verification process on Cash App, it’s not uncommon to stumble upon a few roadblocks. Imagine you’ve entered all your details correctly, but the system stubbornly refuses to cooperate. Often, the culprit could be something as simple as a typo or an outdated app version. Before frustration kicks in, take a deep breath 🍃 and double-check your personal information for any errors. Those inadvertent misspellings – like ‘February’ turning into ‘Febuary’ or ‘independent’ being typed as ‘independant’ – can throw a wrench in the gears of a smooth verification journey.

Should those hiccups persist, and you find yourself wedged in a verification quagmire, don’t hesitate to clear the app’s cache or ensure that your app is the latest version. Sometimes, it’s the more technical side that needs a nudge. If you’re curious about optimizing your device further, perhaps learning about what is the default messaging app for android could shine a light on other functionalities you might be missing out on. This knowledge can expand your horizons beyond Cash App, enhancing your overall android user experience. 📱💡

Unlocking Higher Limits and Features 🔓

Once your identity is firmly established in the digital ecosystem of Cash App, a vista of enhanced features and elevated transactional capabilities unfurls before you. Imagine sending or receiving sizeable payments with the tap of a finger, or investing in stocks without the shackles of low ceilings holding you back—these are but a snippet of the freedoms that await upon verification. Alongside these expanded monetary thresholds, the horizons of your Cash App utility stretch to include exclusive access to Bitcoin transactions, granting you a foothold in the flourishing world of cryptocurrency. 🌟 Moreover, Cash App’s added layers of security post-verification weave a more robust safety net, safeguarding not just your funds but also your peace of mind. It’s a seamless transition from the simple to the sophisticated; from the everyday user to the empowered financier, all within the same user-friendly interface you’ve grown to trust.💼 🛡️

| Feature | Before Verification | After Verification |

|---|---|---|

| Send Limits | $250/week | $2,500/week |

| Receive Limits | $1,000/month | Unlimited |

| Bitcoin Transactions | Not Available | Available |

| Investing | Limited | Extended Options |

The gateway to this expanse of possibilities is merely a verification away; and once you’ve crossed that threshold, the added perks reflect not just in your app’s operation but also in the confidence with which you navigate the financial landscape. An error such as entering a miniscule amount will no longer thwart your ambitions, since with verification comes the capacity to push boundaries and the freedom to redefine limits.

Protecting Your Account Post-verification 🛡️

Once your Cash App has been verified, your journey towards maintaining robust security is just geting started. 🛡️ Think of it as a garden: freshly planted and primed to grow, but without ongoing care, it’s vulnerable. Cyber threats are the weeds, ever-looming and always thriving on neglect. Start with a strong password: a mix of letters, numbers, and special characters that is not easily guessable yet memorable enough for you to avoid frequent resets. Enabling the two-factor authentication (2FA) feature is akin to putting a fence around that garden, adding an extra layer of security, ensuring that even if someone gets hold of your login credentials, they won’t easily access your account.

Stay vigilant about phishing scams—those deceitful emails and messages that trick you into giving away sensitive information; remember, Cash App will never ask for your sign-in code or PIN outside the app. 🎣 Keep the app and your device’s operating system updated to patch potential security vulnerabilities. Lastly, regularly review your transaction history and set up notifications to alert you of any activity; that way, you’re like the neighbor who keeps an eye on the neighborhood, ready to spot anything out of the ordinary. By taking these precautions, you uphold the integrity of your digital financial presence, ensuring it flourishes safely within the vast cyber ecosystem. 🌐