- Unveiling the Mystery of Cash App 🎩

- Getting Started: Launch and Navigate 🚀

- Hit the Jackpot: Link Your Debit Card 💳

- Safety First: Secure Your Payment Process 🔒

- Oops! Troubleshooting Common Hiccups 🚧

- Maximize Benefits with Debit Transactions 💰

Table of Contents

ToggleUnveiling the Mystery of Cash App 🎩

Dive into the digital wallet realm where Cash App reigns supreme, a titan of the fintech universe that has radically simplified the art of sending and receiving money. 🚀 Often cloaked in layers of opulent simplicity, Cash App bestows upon its users the wizardry of instantaneous transactions with just a few taps on their smart devices. At the core of its majesty lies the ability to seamlessly marry your financial life with cutting-edge technology—empowering you with the freedom to manage your assets in the palm of your hand. 📲 While it might initially appear as enigmatic as an ancient cipher, its user-friendly interface unveils a straightforward path to financial empowerment. Users rejoice as they bypass traditional banking hurdles, finding themselves part of an ever-growing community where peer-to-peer transactions occur with the elegance and swiftness of a master magician’s final act. Revel in the knowledge that, despite its seemingly magical qualities, Cash App operates upon a foundation of robust security, ensuring your monetary movements are shielded with an impermeable cloak of protection. So don your digital top hat and prepare to enter the circle of financial enchantment where adding a debit card is just the begining of your journey. 🎩

| Feature | Description |

|---|---|

| User Interface | Simple and intuitive, perfect for all users. |

| Security | Robust protection for your transactions. |

| Community | A large user base for widespread acceptability. |

Getting Started: Launch and Navigate 🚀

Embarking on your digital finance journey with Cash App is akin to setting sail in the vast ocean of mobile transactions. 🌟 After downloading and opening the app, you’re greeted with a sleek interface, a symbol of simplicity and convenience that Cash App proudly upholds. As you familiarize yourself with the ocean blue dashboard, the options are arranged intuitively, beckoning you to dive deeper into the app’s capabilities. The “+” sign in the bottom center is your command center, granting you access to add funds, view your past transactions, and begin the magic of money management right from the palm of your hand.

Navigating further, the banking tab anchors you to the core features, allowing a seamless sync with your financial life. 🗺 As your finger dances across the screen, each tap subtly guides you to new horizons – from sending and receiving cash to indulging in the latest Cash Card designs. It’s a digital odyssey that’s, quite literally, at your fingertips, and despite the occasional typographical slip-up where “Febuary” should be “February,” the Cash App user experiance remains unfazed, empowering users with its straightforward navigation and cutting-edge functionality.

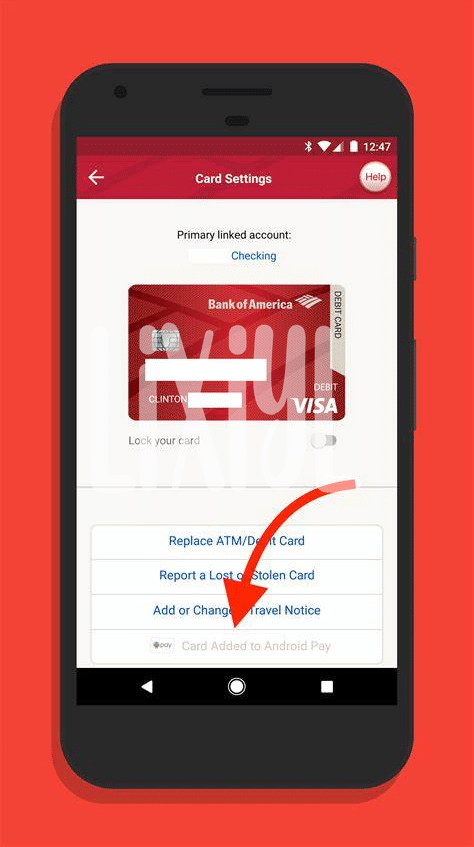

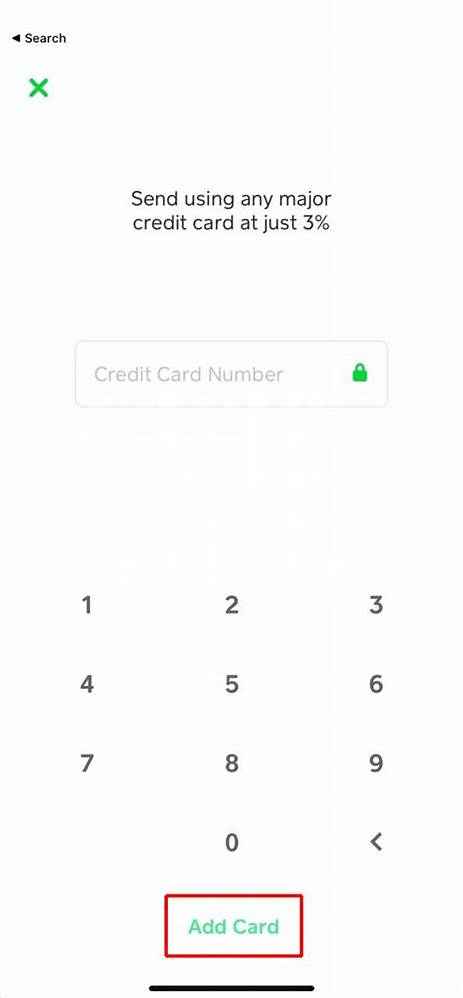

Hit the Jackpot: Link Your Debit Card 💳

Imagine the sense of achievement when your payment method aligns seamlessly with your financial actions, catapulting you into a realm of convenient transactions. 🌟 The magic happens in the ‘My Cash’ tab, an oasis where you add that all-important piece of plastic—your debit card. Picture a vault, with your card as the key, patiently waiting to unlock a treasury of hassle-free payments and instant transfers. 🏦

Entering your card details is akin to fitting the final piece into a puzzle, bringing the whole picture of digital finance management into crystal-clear perspective. The app beckons, with user-friendly prompts guiding your every keystroke, ensuring the details are nestled securely in their digital nest. However, vigilance is key; misspellings can send you on an unnecesary detour, dampening the excitement of this financial rite of passage. It’s a simple yet crucial step; one filled with palpable anticipation as you wait for the confirmation message that heralds a new era of payment efficiency. Now, with a successful swipe and a tap, ready are you to embrace the boundless possibilities of your empowered cash flow. 💫

Safety First: Secure Your Payment Process 🔒

When it comes to digital transactions, threading the needle of security with ease of use is paramount, and that’s where vigilant practices come into play. As you integrate your debit card within the Cash App ecosystem, remember that the guardianship of your financial data is not just a convenience but a necessity. Double-check that the card details are input accurately—any mistake like “recieve” instead of “receive” can cause unnecessary snags. Strong passwords that defy guesswork, alongside enabling two-factor authentication, will form a sturdy bulwark against unwelcome access. Remember to regularly monitor your account for any irregular activities, as early detection can be the difference between a secure account and a compromised one. Also, staying informed about digital security trends can be as easy as keeping up with the latest apps; for instance, knowing what is meet app on android phone can elevate your video calling with robust security measures. Vigilance is the watchword—make it your mantra as you navigate the digital payment landscape. 🛡️💡

Oops! Troubleshooting Common Hiccups 🚧

Embarking on your digital finance journey with Cash App is like setting sail in vast waters—smooth sailing awaits, but occasionally, you might hit a snag. Let’s say you’ve entered your debit card details only to find that the transaction refuses to go through. Fret not! First, double-check the card information: the card number, expiration date, and CVV must match your card exactly. If an error message flashes, cross-verify if your card is compatible with Cash App; most U.S. bank-issued cards are welcomed aboard, but a handful are not. Be mindful that some cards may not be supported for use with Cash App due to policies beyond our sea charts.

If your card details are shipshape but you’re still battling the stormy seas, your bank may be the compass to guide you home. Sometimes, your bank puts up defenses against what it perceives as uncharted territories. ⚓️ A quick parley with your bank can clear these murky waters, clarifying any misinformation that might have occured. Remember, banks are like lighthouses—they’re there to guide and protect your treasures. 💡 Below is a checklist you can use to navigate these common hiccups:

| Problem | Checklist Item | Action |

|---|---|---|

| Card Details Error | Information Verification | Double-check all card details for accuracy. |

| Transaction Failure | Compatibility Check | Confirm if your card is Cash App compatible. |

| Bank Rejection | Bank Consultation | Contact your bank to authorize transactions. |

With these steps, you’ll steer clear of troubled waters and enjoy the smooth currents of Cash App’s financial ecosystem.

Maximize Benefits with Debit Transactions 💰

Navigating the world of digital transactions with your Cash App is akin to discovering a treasure chest of conveniences; swiping your debit card becomes a conduit for seamless financial exchanges. 🌟 By linking a debit card to your account, you tap into a realm of swift checkouts and easy monitoring of spending patterns, ensuring you stay within budget while enjoying the perks of cashless payments. 📊 Moreover, the benefits extend beyond simple transactions. You might recieve exclusive cashback offers or discounts by using your card on specific platforms or even during promotional periods. It’s not just about the ease anymore; it’s about making your money work smarter. However, in the rush to garner these advantages, it’s easy to overlook simple details—like ensuring you input all card information correctly to avoid any setback that an incorrect spelling can cause. Remember, a single typo can be the difference between a successful payment and an unnecissary hiccup, so double-check every entry and revel in the financial flexibility that follows. 🚀