- Embrace Money Zen with Budget Planners 📊

- Snap and Sort Bills with Ocr Apps 📸

- Stay Alert with Real-time Bill Trackers 🔔

- Share Expenses with Roomies Using Split Apps 💸

- Unpuzzle Subscriptions with Reminder Tools 🔍

- Go Green: E-bills and Paperless Management 🌱

Table of Contents

ToggleEmbrace Money Zen with Budget Planners 📊

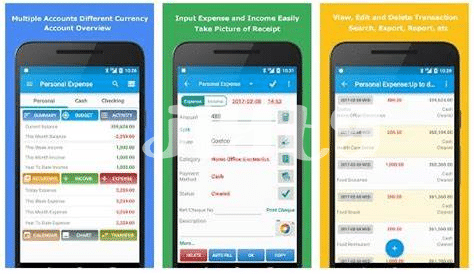

When it comes to managing household bills, there’s nothing like having a trusty budget planner in your corner. These handy apps work like a financial fairy godmother, transforming your numbing numbers into neat nuggets of know-how. Imagine seeing your cash flow as clear as day, guiding you away from the dreaded FOMO spending and towards a more serene savings journey. With charts and graphs, you can visualize where every penny is going and make sure your hard-earned money is used wisely, rather than giving in to impulsive bagholder habits. 🚀

The right app not only keeps you in the loop but also makes it a breeze to set goals that feel like a game you’re winning, rather than a chore. You’ll be HODLing onto your money with diamond hands, steering clear of unnecessary indulgences and instead, focusing on what truly matters in your financial universe. And let’s face it, with a little help, who wouldn’t want a slice of money zen? Plus, you won’t recieve any nasty surprises when it’s time to pay the piper. 🌟👛

| Feature | Description |

|---|---|

| Visual Budgeting | See your expenses in colorful charts and graphs. |

| Goal Setting | Create savings goals to help guide your spending. |

| Expense Tracking | Keep an eye on every transaction and bill due date. |

Snap and Sort Bills with Ocr Apps 📸

Picture this: It’s a laid-back Sunday afternoon, and instead of enjoying a peaceful weekend, you’re drowning in an ocean of paper bills, trying to figure out what needs to be paid, by when, and how much you owe. Sounds familiar? Well, not anymore! The latest Android apps are here to change the game with cutting-edge OCR (Optical Character Recognition) technology. Imagine just taking a photo of your bills, and like magic, the app reads, sorts, and saves all the important details. No more typing numbers or due dates manually.

These clever little helpers can even categorize your expenses, so you get a clear idea of where your money is flowing – whether it’s electricity, water, or that sneaky streaming service subscription you forgot about. And if you’re worried about your data, rest assured that most apps come with tight security measures to keep your financial details locked down tighter than a mooning crypto market.

With OCR at your fingertips, you can recieve real-time updates on what’s due, what’s been paid, and what needs your attention – minus the normie struggles of bill management. And for those who’ve been hodling on to paper bills, expecting their value to increase – spoiler alert – it doesn’t work that way! So why not leap into efficiency and embrace the e-bill revolution with one of these top-notch Android apps of 2024? 🌟📈💡

Oh, and while managing your bills like a pro, peeking into personal wellness is just as simple. Stay in top shape by checking out what is the best health app for android 2024, where you can find apps designed to keep you as healthy as your finances.

Stay Alert with Real-time Bill Trackers 🔔

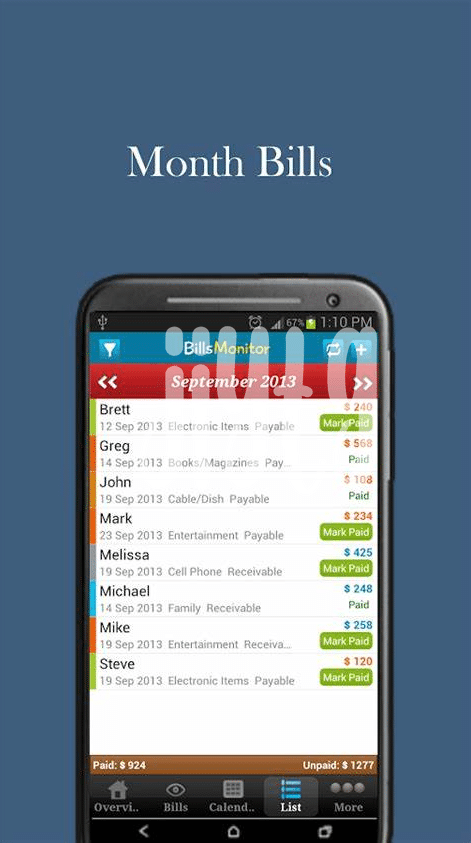

In a world where we’re all juggling a zillion things at once, the last thing we want is a surprise bill shaking our financial stability. Imagine a buddy that nudges you softly every time a payment’s due, making sure you’ve got everything in control – yep, that’s the magic of real-time bill trackers. 🌟 These nifty apps are like your financial guardian angels, ensuring you’re never caught off guard. You get updates straight to your phone – think of it like receiving a friendly text – that reminds you when it’s time to part with your hard-earned cash for bills. No more FOMO when it comes to keeping up with payments! And let’s be real, we could all use more Zen in the money department. 💗 If a payment does slip through the cracks, some apps even have the nudge to ‘BTD’ with helpful reminders to settle up before you get in too deep. It’s time to swap out those ‘Oops, I forgot’ moments with a slick, no-sweat system that keeps your finances in check – be they big, small, or somewhere in the bagholder territory. Just remember to DYOR to pick the best one that fits your lifestyle. 🚀

Share Expenses with Roomies Using Split Apps 💸

Living with roommates has its perks, but when it comes to splitting bills, it can often become a complex dance of numbers and receipts. Thankfully, the latest apps make it easy as pie to manage shared expenses without the headache. Imagine grabbing brunch with your friends and instead of playing math wizard at the table, you simply enter the total into an app, and presto! Everyone’s share, including that extra side of avocado, is calculated in a snap. These smart tools are financial game-changers; they not only keep the peace at home but also ensure no one gets left feeling like a bagholder with more than their fair share of the bills.

As times evolve, so do our habits, and going digital with expense management is definately a move toward smarter living. While some fear becoming the normie of the group, others embrace the chance to have eagle-eyed oversight over their finances. And for those health-conscious individuals who meticulously track every aspect of their well-being, finding what is the best health app for android 2024 can be just as important as financial tools. So, gather your flatmates, download a nifty app, and transform the way you split bills, so you’re all set for whatever the future holds – untill next month’s bills come in, that is.

Unpuzzle Subscriptions with Reminder Tools 🔍

Imagine a world where keeping track of all your streaming services, gym memberships, and various online subscriptions is as easy as pie 🥧. That’s where the modern marvel of reminder tools shine. They’re like the trusty sidekick, wading through the chaotic swamp of monthly payments to fish out the ones that really matter. With just a few taps, these clever apps fetch details of every deal you’ve signed up for, keeping an ever-watchful eye on when the next payment’s due.

Without such a sidekick, you might end up like a bagholder, lugging around subscriptions you’d forgotten, while your hard-earned cash trickles away. These tools don’t just list your outgoings; they’re savvy enough to send you alerts before your next charge 🛎️. It’s like having a financial guardian angel that helps you avoid those sneaky auto-renewals which can easily slip past when life gets busy. Say goodbye to those “oops, I didn’t mean to renew that” moments. And the best part? Some apps even show you how to cancel subscriptions, slashing unwanted fees and helping keep your budget in the green zone. So, let’s make peace with our bank accounts – by making sure we only pay for what we truly use, and nothing more.

| Features | Description |

|---|---|

| Alerts & Notifications | Sends timely reminders before each bill is due. |

| Subscription Inventory | Keeps an updated list of active subscriptions. |

| Cancellation Assistance | Guides on how to cancel services no longer needed. |

| Budget Tracking | Monitors subscription expenses to help manage finances better. |

| Analysis & Reports | Provides insights on where your money is going each month. |

Go Green: E-bills and Paperless Management 🌱

Imagine a world where your bills are as light on the planet as they are on your mind. With the rise of electronic bills, the modern household is shifting toward a cleaner, more streamlined process of managing finances. It’s a sweet goodbye to the days of neglected paper bills piled up on the kitchen counter. Instead, you receive a simple notification 📩, and with a few taps, you’re done, effectively shrinking your carbon footprint while keeping your budget in check. By choosing e-bills, not only do you embrace eco-friendly practices 🌿, but you also side-step the FOMO of missing due dates and the unease of misplacing important documents. This method is not just smart; it’s also an expression of ‘diamond hands,’ showing a commitment to holding onto sustainable choices, despite the swirl of more traditional—and often more wasteful—options. It might take a bit of adjustment, but once you get the hang of it, you’ll wonder how you ever managed without it. And remember, this isn’t just about avoiding the clutter of paper; it’s about casting a vote for the kind of enviroment we want to live in. So, let’s take the leap into the digital age of bill managment and watch our stress—and our paper trails—dwindle. 🌐